Having understood "what is a ULIP?" the next question that you probably have is this: Why should I invest in a ULIP? Let us look at this.

Why Should I Invest in a ULIP?

Investing in ULIPs can help you meet various life goals, both in the short term and the long term. You can experience many benefits by investing in ULIPs. These benefits include:

- Disciplined and regular savings

- Financial assistance through insurance

- Goal-based financial planning

- Flexibility in investing

- Tax-free withdrawals and tax benefits, subject to provisions of Income Tax Act, 1961.

Now that you have the answer to your question “Why should I invest in a ULIP?”, you need to look at another important aspect before investing in a ULIP. This element is the Benefit Illustration, which accompanies every Unit Linked Insurance Plan. The Insurance Regulatory and Development Authority of India (IRDAI) has made it compulsory for all insurers to provide a Benefit Illustration (BI) to investors who buy ULIPs.

What is a ULIP Benefit Illustration?

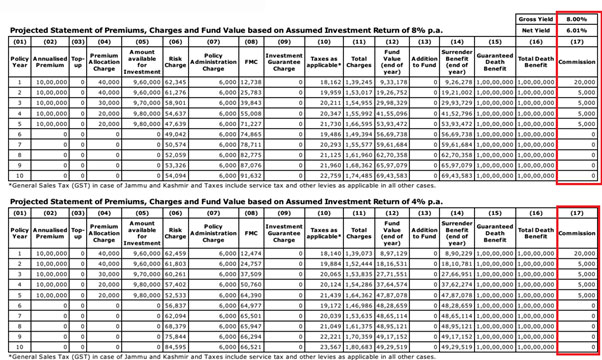

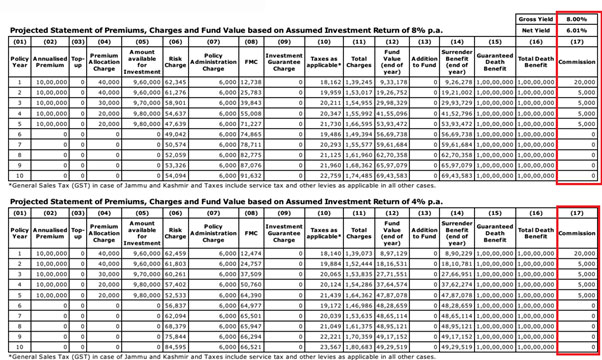

A ULIP Benefit Illustration effectively shows you a year-by-year summary of the charges and the returns associated with the plan. It shows you various details like how your premium will be invested each year, what ULIP charges will be deducted from your investment, and how your fund value will earn returns over the course of the policy’s duration.

Additionally, a Benefit Illustration helps you understand how the ULIP charges affect your returns, and how the death or surrender value of your ULIP varies on a year-by-year basis across the policy duration. By referring to the Benefit Illustration before purchasing a ULIP, you can visualize how your investment will grow over the next few years. This can be very helpful in planning your finances to meet your life goals at various stages of your life.

Common Terms Used in a ULIP Benefit Illustration

There are many terms related to ULIPs and life insurance that you will find in a Benefit Illustration. Understanding these words and phrases can help you read a Benefit Illustration better. Therefore, here is a closer look at some of these terms, along with their explanations. Not all terms may be the same in all benefit illustrations provided by insurance providers; however, one could take clarity from respective providers if in doubt.

Policy Year

This term refers to the number of years you stay invested or the term chosen by you for the ULIP Policy. In simple words, it is the Policy term.

Annualized Premium

This is the premium that you need to pay each year.

Premium Allocation Charges

This is one of the front-end ULIP charges, levied as a percentage of the annual premium paid. The premium allocation charges are generally higher during the initial years.

Mortality Charges

This cost is charged by the insurer towards the insurance cover by way of cancellation of units under the policy. A few factors depend on your age, on the sum at risk, and the policy term. This could also be deducted monthly as per the conditions stated in the policy document.

Policy Administration Charges

These ULIP charges can be fixed or may vary as a percentage of the fund value or premium. It is deducted from the fund value each month during the course of the policy duration.

Fund Management Charges

These are charged as a percentage of your fund value for managing your funds over the course of the policy’s duration.

Fund Before FMC

This term refers to the underlying value of the fund before fund management charges are deducted.

Fund at the End

This term refers to the value of the fund at the end of the year, after all the charges have been deducted and growth has been accounted for.

Net Yield

This refers to the net returns you earn from your ULIP after considering the overall impact of all the ULIP charges.

Surrender Value

This is the amount paid to you if you exit the plan. There is a 5-year lock-in period for ULIPs.

As you can see in the illustration above, the various columns of the BI show the terms and values previously discussed. For the purpose of the illustration, it is necessary to assume a certain annual growth rate in order to display the different values for each policy year. As per the current regulatory mandates, insurers are required to prepare two scenarios at the assumed investment return of 4% and 8% respectively.

Factors You Should Look Out for in a BI Before Buying the ULIP

Before buying a ULIP, there are some key things you should look out for in a Benefit Illustration. These are discussed below:

Authenticity of the BI

If you are purchasing your ULIP through an agent, ensure that the BI shown to you is authentic and prepared on the insurer's official software.

Verification of Key Details

Look for a specific Version Number, a unique identification number, and the company's name, logo, and registered office address.

By paying attention to the details in the BI, you can make an informed decision about the right ULIP to invest in.

An ISO 9001:2015

An ISO 9001:2015