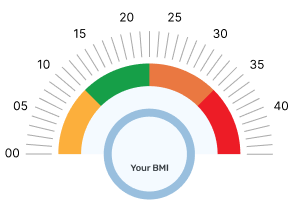

In order to be able to fully comprehend the concept of Body Mass Index, it is crucial to not just stop with the calculation part. Only by interpreting the calculated BMI values using the recommended body weight and BMI range can you ever hope to understand your Body Mass Index.[4]

The following table clearly represents the categories based on BMI values.

BMI

| Category

|

|---|

< 18.5

| Underweight

|

18.5 to 24.9

| Normal weight

|

25 to less than 29.9

| Overweight

|

> 30

| Obese

|

By comparing your results with the values in this BMI index table, you can accurately identify the category that you belong to. For instance, if your BMI is less than 18.5, you are categorized as underweight. If your BMI falls in a range between 18.5 and 24.9, you are considered to be normal weight with a normal BMI. If your BMI falls in a range 25 to 29.9, you fall under the overweight category. If your BMI is 30 or more, you are considered to be under the obese category.

Both the underweight and the obese categories are usually considered by healthcare professionals to be high-risk. This is primarily because the individuals coming under these two categories are typically at higher risk of contracting ailments and diseases, as we will see later in this article.

Ideal BMI for men

When it comes to men and women, there are several physiological differences between the two genders. Therefore, it becomes necessary to determine the ideal BMI for men. The Body Mass Index is something that is dependent on a person’s overall height and weight, and so, there is a BMI chart for men that clearly outlines the range of BMI values and the various weight categories. Here is a brief look at the chart.[5]

BMI Chart Men

|

|---|

BMI

| Category

|

|---|

< 18.5

| Underweight

|

18.5 to 24.9

| Normal weight

|

25 to less than 29.9

| Overweight

|

> 30

| Obese

|

Due to the various physiological differences between the two genders, men tend to carry more muscle in their bodies. As a result, a man and a woman with the same BMI may both be grouped in the same category, but their body composition may be entirely different. The same is true for two men - one of whom is a regular person and the other an athlete. The athlete, due to higher muscle mass, may be in the overweight or obese category while being perfectly healthy. Therefore, overall, the BMI calculator for men simply shows how much excess body weight a person has, if any.

While being overweight and obese is generally considered high-risk, men falling under these two categories due to having more muscle in their bodies are not necessarily more prone to health risks. However, if you are an adult male who is sedentary with a high BMI, it may be a cause for concern.

Since the BMI is based on two factors - height and weight, the Body Mass Index tends to change with respect to these two values. Here is a comprehensive table that clearly illustrates how the BMI shifts with different heights and weights in men.

Weight(kgs)

| Height (in feet and inches)

|

|---|

5 feet

| 5 feet 3 inches

| 5 feet 6 inches

| 5 feet 9 inches

| 6 feet

|

|---|

| 65 | 28.0 | 25.4 | 23.1 | 21.2 | 19.4 |

| 75 | 32.3 | 29.3 | 26.7 | 24.4 | 22.4 |

| 85 | 36.6 | 33.2 | 30.2 | 27.7 | 25.4 |

| 95 | 40.9 | 37.1 | 33.8 | 30.9 | 28.4 |

| 105 | 45.2 | 41.0 | 37.4 | 34.2 | 31.4 |

Ideal BMI for women

Just like how there is a range of BMIs for men; there are ranges of BMI for women too. You will find this in the BMI chart for women. Since the BMI depends on the height and weight of a person, these metrics are used in a BMI calculator for women as well, just like how they are used in a BMI calculator for men. BMI for women indicates how much excess weight a women of a certain height has, thereby making it easier to classify them as underweight, normal, overweight or obese.

That said women, in general, tend to have a higher percentage of body fat than men do. Therefore, for a man and a woman with the same BMI, the former may have more muscle, while the latter may have more body fat. Nevertheless, the BMI for women[5] follows the same range as the BMI for men.

Here is a BMI chart for women that gives you a preview of the ranges of BMI and what they mean.

BMI Chart Women

|

|---|

BMI

| Category

|

|---|

< 18.5

| Underweight

|

18.5 to 24.9

| Normal weight

|

25 to less than 29.9

| Overweight

|

> 30

| Obese

|

When you are using a BMI calculator for women, it helps to remember that women tend to put on more weight as they age. This is one of the reasons why some BMI calculators for women consider BMI cut-offs like 30, 32 and 33 instead, as normal.

However, broadly speaking, the same ranges are used for both men and women over the age of 20. To help you better understand how the BMI changes with height and weight, here is an illustrative table.

Weight(kgs)

| Height (in feet and inches)

|

|---|

5 feet

| 5 feet 3 inches

| 5 feet 6 inches

| 5 feet 9 inches

| 6 feet

|

|---|

| 55 | 23.7 | 21.5 | 19.6 | 17.9 | 16.4 |

| 65 | 28.0 | 25.4 | 23.1 | 21.2 | 19.4 |

| 75 | 32.3 | 29.3 | 26.7 | 24.4 | 22.4 |

| 85 | 36.6 | 33.2 | 30.2 | 27.7 | 25.4 |

| 95 | 40.9 | 37.1 | 33.8 | 30.9 | 28.4 |

Ideal BMI for kids

A BMI calculator for kids can help you determine the body mass index for children. However, is the way the BMI is calculated different for kids than for adults? It turns out that there is a bit of a difference. Calculating the ideal body weight and BMI for kids[6] differs from the method used for adults.

This is because the amount of body fat in a child’s body keeps changing as they grow up, unlike in the case of adults where it is mostly fixed. Here are the details about the child BMI calculator metrics.

- The formula used to calculate the BMI in children is the weight divided by the height in meters squared. This result is then multiplied by 703.

- The BMI of each child is then matched against the percentiles for other kids who are of the same age and gender.

- Percentile measures how a child compares to other children of the same gender, in the same age group.

- A child whose BMI falls in the 10th percentile, for instance, weighs more than 10% of the kids in his or her age group.

- Kids with a BMI that falls below the 5th percentile are underweight.

- A BMI between the 5th and 85th percentile is considered normal.

- Children with a BMI between the 85th and 95th percentile are considered overweight.

An ISO 9001:2015

An ISO 9001:2015