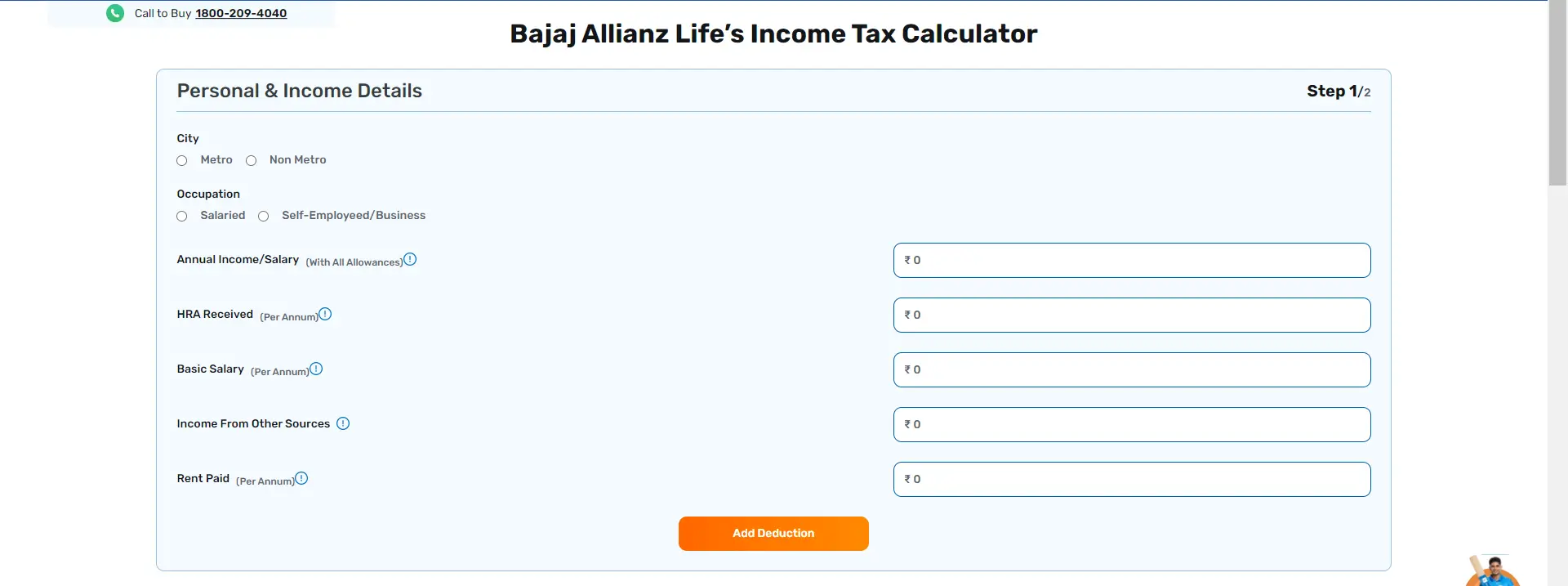

Here’s how life insurance plans help in saving tax liability –

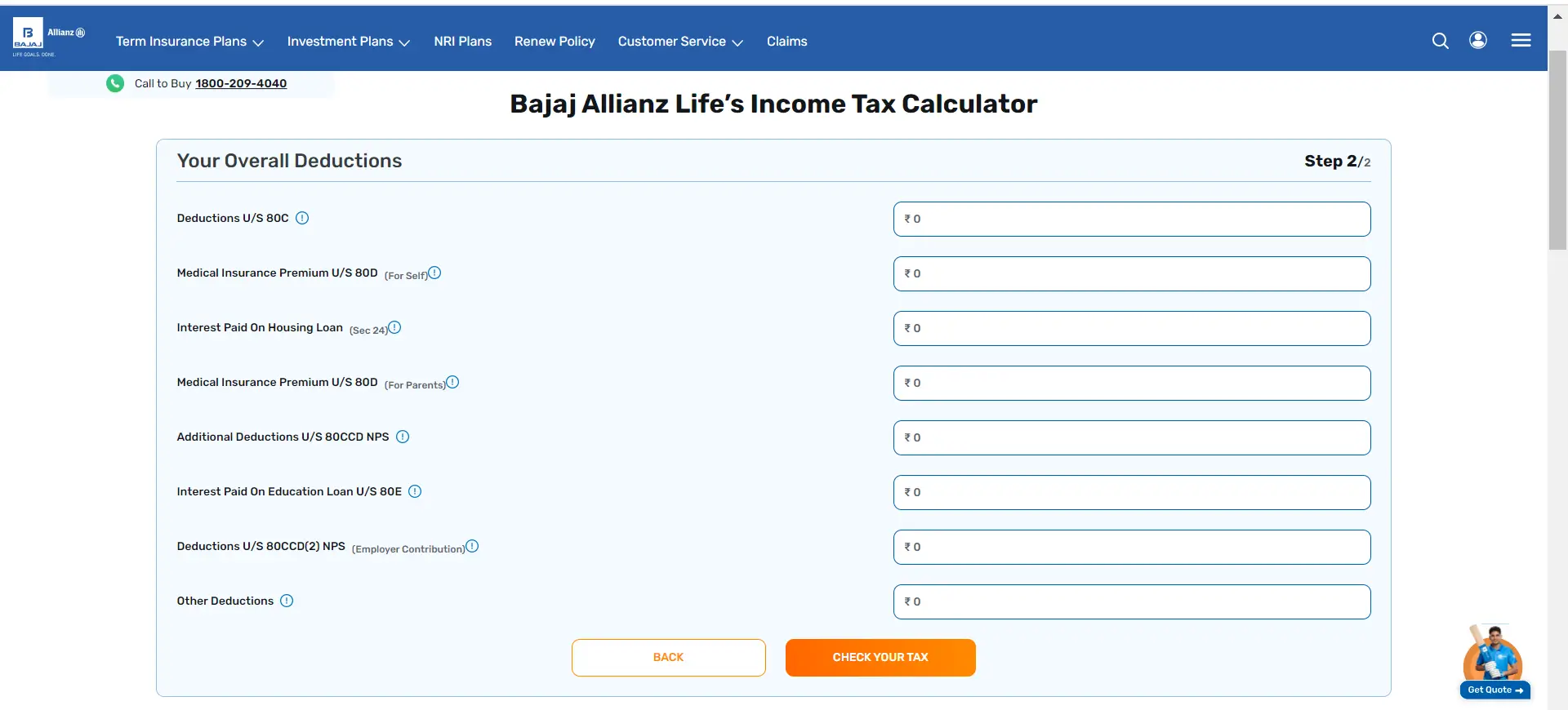

- If you buy the policy on or after 1st April 2012 and the premium is not more than 10% of the sum assured, the premium will be allowed as a deduction under Section 80C up to ₹1.5 lakhs.10

- However, in case the plan is issued before this date, the premium should be within 20% of the death sum assured to claim the tax benefit10

- If the life insured has a disability mentioned under section 80U or suffers from a disease specified under Section 80DDB, and the plan is issued on or after 1st April 2013, the premiums should be up to 15% of the death sum assured to be eligible for deduction

- The death benefit is tax-free10

- For ULIPs bought on or after 1st February 2021, the total maturity benefit will be tax-free if the aggregate annual premium is up to an amount of Rs.2.5 lakhs11. If the premium exceeds Rs.2.5 lakhs, the gain from such policy will be taxable as capital gain11. It would be taxed as follows –

- In the case of equity funds, returns up to an amount of Rs.1.25 lakhs would be tax-free. If the returns exceed Rs.1.25 lakh, the excess would be taxed at 12.5%12

- In the case of debt funds, .

However, the taxation of policies wherein the annual premium exceeds Rs.2.5 lakhs is applicable only on policies issued on or after 1st February 2021. If you have bought the policy before this date, the maturity benefit would be exempted even if the premium is more than Rs.2.5 lakhs provided policy is satisfying the criteria mentioned in Section 10(10D) of the Act11.

For traditional policies, the maturity benefit will be tax-free under Section 10(10D). However, for policies issued on or after 1st April 2023, the maturity benefit will be tax-free if the aggregate premiums are up to ₹5 lakhs. If the premiums are higher, the excess returns would be taxable11.

-Calculator.svg)

An ISO 9001:2015

An ISO 9001:2015