Some term plans also have inbuilt riders wherein riders are built into the scope of the policy. You don’t have to choose the riders individually and the premium is inclusive of the riders added under the plan.

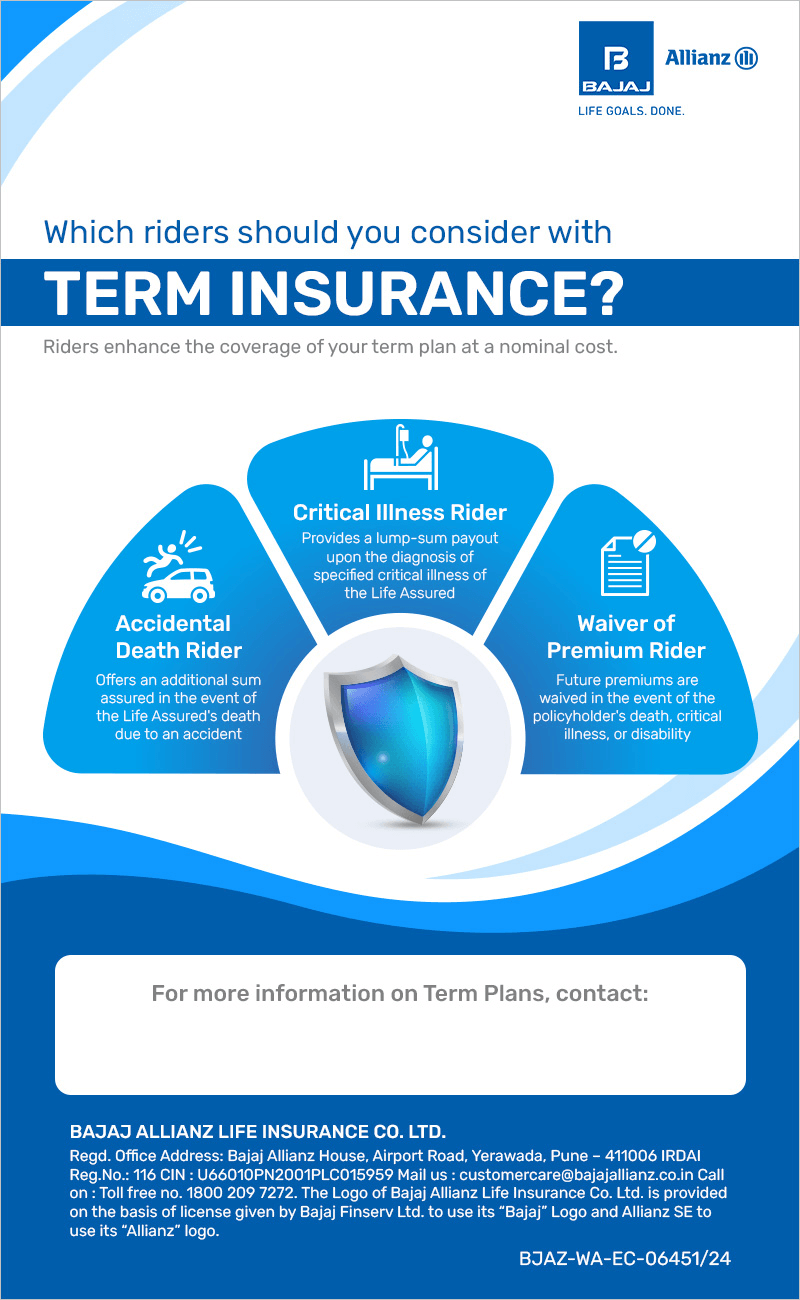

Types of Riders Available with Term Insurance

Some of the different types of riders available with term insurance plans are as follows1 –

| Types of riders | How does the rider work? | Benefits of the rider |

The rider covers accidental death occurring during the policy tenure. If the life assured passes away in an accident, the rider's sum assured is paid along with the death benefit under the terms plan, as per policy terms and conditions. |

| |

Under this rider, the future premiums for the policy are waived if the policyholder or life assured becomes disabled or suffers from a critical illness during the tenure and is unable to pay future premiums. The condition of the rider being activated depends on the policy you choose and may vary from insurer to insurer. |

| |

The rider covers specified listed critical illnesses. If the life assured actually suffers from any of the covered illnesses during the rider tenure, the sum assured under the rider is paid |

| |

Family income benefit rider | Under this rider, a percentage of sum assured is paid to the nominee(s) if the life assured passes away during the tenure |

|

Reasons You Need a Rider in Term Insurance

There are many benefits of adding riders ito term insurance. However, some of the common benefits which make choosing riders a good choice are as follows –

1. Added protection

One of the primary rider benefits is the added protection that it provides. Whichever rider you choose; you get an added layer of protection against unforeseen eventualities which might cause a financial loss.

2. Coverage for contingencies other than death

While the term plan covers the risk of premature demise, the riders can provide coverage against medical emergencies, critical illnesses and disabilities. They pay a benefit in any of these contingencies (depending on which rider you choose) and extend financial assistance when you need it the most.

3. Minimal premium

Riders are very cost-effective. The rider premium is low making it affordable. You can enjoy a high rider sum assured at low additional premiums on the base plan so that your coverage is enhanced without burning your pockets.

4. Tax benefits

The rider premiums are clubbed with your term insurance premium and allowed as a deduction under Section 80C of the Income Tax Act, 1961 up to Rs.1.5 lakhs2 subject to the terms and conditions stated therein. This is available for term insurance riders like accidental death riders, accidental death and disablement riders and any other rider which does not offer health insurance-related coverage2. For riders like critical illness riders, hospitalisation coverage riders, terminal illness riders, and others who provide health-related cover, the rider premium is allowed as a deduction under Section 80D up to Rs.25,000 if you are below 60 and Rs.50,000 if you are a senior citizen2.Above benefits are available only under old regime of Tax.

The Process of Buying Term Insurance Riders

You can choose to buy term insurance riders with your base policy when buying the base policy. Many policies also allow you to add the rider to the coverage during renewals. You can buy the riders online or offline depending on your suitability.

Bajaj Allianz Life Term Insurance Riders

Bajaj Allianz Life Insurance offers a range of riders with its term insurance plans. These riders are as follows –

| Rider offered | Coverage |

| Bajaj Allianz Accidental Death Benefit Rider | The rider covers accidental deaths occurring during the policy tenure. If the insured dies in an accident, the sum assured of the rider is paid. |

| Bajaj Allianz Accidental Permanent Total or Partial Disability Benefit Rider | This rider covers permanent total or partial disabilities suffered in an accident during the policy tenure. If the insured suffers from either of the contingencies, a lump sum rider benefit is paid. |

| Bajaj Allianz Waiver of Premium Benefit Rider | This rider waives the premium if any of the following contingencies occur –

|

| Bajaj Allianz Family Income Benefit Rider | In case of death of the life assured early on or due to an accidental disability, this rider provides the benefit of 1% of the rider sum assured, payable monthly for the remaining rider term or 10 years whichever is higher. |

Conclusion

Choose suitable riders with your term insurance plan and enjoy the benefits of added coverage, enhanced financial security and tax benefits at minimal premiums. You can cover other contingencies too and get complete peace of mind with an inclusive scope of coverage. So, assess your coverage needs and then make your term plan comprehensive with the necessary riders.

FAQs

1. Is there a medical examination required to add a rider to my term policy?

Usually, no medical examination is needed to add a rider to your term policy. However, in some cases, a medical examination might be needed by the insurer before the rider coverage is granted.

2. Can I convert a term insurance rider into a permanent policy later on?

Usually, a rider cannot be converted into a permanent term insurance policy. It is added to the basic policy and runs till the base policy runs or till the tenure of the rider. You cannot buy the rider separately.

BJAZ-WEB-EC-06519/24

An ISO 9001:2015

An ISO 9001:2015