What is 15G and 15H?

Form 15G and Form 15H are self-declaration forms that individuals submit to exempt them from tax as their income is below the taxable limit. You can avoid TDS (Tax Deducted at Source) on your income by submitting either of the two forms to the relevant organisations such as banks, post offices, etc. While Form 15G is applicable for Indian residents under 60 years old, Hindu Undivided Family (HUF) and trust, 15H form is for residents who are 60 or above the age of 60. HUF cannot submit Form 15H.

Form 15G helps people whose gross annual income is below ₹2,50,000 (under the old tax regime) or ₹3,00,000 (under the new regime). For senior citizens (people aged between 60-80 years of age), Form 15H helps in preventing TDS deductions if your annual income is less than ₹ 3,00,000. In the case of super senior citizens, individuals who are above the age of 80, the basic exemption limit is ₹ 5,00,000 for FY23-24.

When should you submit Form 15G or 15H?

Ideally, these forms have to be submitted at the beginning of the financial year to prevent TDS deductions on the income interest from the onset. You need to submit Form 15G/15H every year to claim tax exemption, as its validity is only for a year. In case you were unable to submit the form at the beginning, you can submit it at any time of the year to avoid further deductions. To claim a refund of excess TDS deducted due to delay or non-submission of Form 15G or 15H, you need to file your Income Tax Return (ITR) first.

What will happen after the submission of Form 15G/15H?

After submission, your financial institution will process and assess your Form 15G/15H to ensure all the details mentioned are correct. Once submitted, you will get confirmation that your form has been received and processed. The bank or the financial organisation will verify the information to confirm whether you meet the eligibility criteria. When they make sure that all the details entered are correct and you qualify for the exemption, no TDS will be deducted from your interest income for the rest of the financial year. You should check your monthly bank statements regularly to ensure that TDS has not been deducted. In case you find any discrepancy, contact your financial institution immediately.

Eligibility Criteria for Form 15G

You need to meet the following conditions to qualify for tax exemption under Form 15G:

- The form should be submitted by an Indian resident below 60 years of age, HUF, or trust.

- You will qualify for this tax exemption only if your interest income is lower than the basic exemption limit, which is ₹ 2.5 lakhs under the old regime and ₹3 lakhs under the new regime.

- You should have no tax liability for that particular year.

- A valid PAN is mandatory for filing the form.

Eligibility Criteria for Form 15H

The key eligibility criteria for Form 15H is as follows:

- The individual who submits the form should be an Indian resident above 60 years of age.

- Your total annual income should be below Rs.3 lakhs (60-80 year-olds) or Rs.5 lakhs (above 80 years of age).

- Your net tax liability should be Nil.

- A valid PAN is necessary while filing Form 15H.

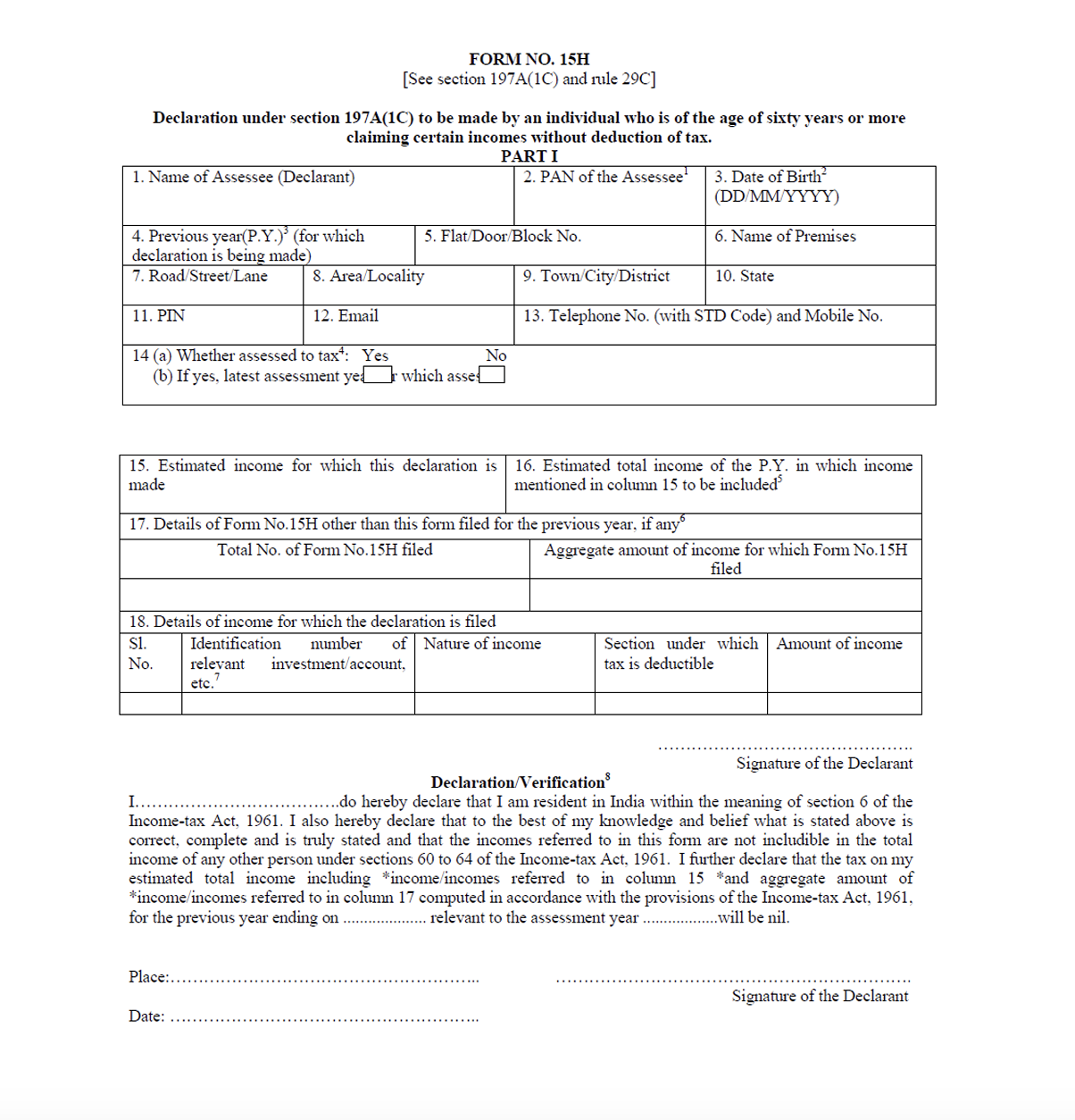

What are the different parts of Form 15G/15H?

Both Form 15G and Form 15H comprise two parts - Part 1 and Part 2. Here’s how they differ –

| Part 1 | Part 2 |

|---|

It contains the personal details and estimated income of the individual applying for tax exemption

| It lists the details of the bank or tenant that is in charge of deducting the TDS

|

Part 1 is filled by the individual submitting the form

| Usually, Part 2 is filled out by the financial institution

|

This part includes information such as name, PAN number, address, estimated income, and investment details

| Part 2 involves the PAN and TAN details of the entity.

|

Sample of Form 15H

To submit form 15G/15H, you need to first log into your Banking account via an Internet banking portal, select the FD for which you want claim TDS using form 15G/15H. NAVIGATE TO THE ‘Quick Actions’ section and select ‘Submit form 15G/15H’. Once you have viewed the form, click ‘Proceed’ and add any additional information. After receiving an OTP on your registered mobile number, verify and complete the submission. Make sure to save the confirmation or acknowledgement after submitting the form for future reference.

Essential Features of Form 15G & 15H You Should Know

Self-declaration forms 15G and 15H allow taxpayers to avoid TDS deductions on interest income. Form 15H is for senior citizens who are resident individuals over 60, whereas Form 15G is for residents under 60, HUFs, and trusts. Both require PAN information, they are valid for a single fiscal year, and must be submitted to EPFO, banks, or post offices. As long as earnings are below the exemption level, submitting these documents helps to ensure smooth cash flow by preventing further tax deductions.

Key Features of Form 15G

The objective of Form 15G is to help taxpayers save unnecessary TDS on their income. Key things to remember are:

- It applies to trusts, HUFs, and individuals or any other assessee but not a company or a firm residing in India below the age of 60.

- When the total income is less than the basic exemption limit, filing is possible.

- A valid PAN is needed for submission.

- Needs to be submitted to EPFO, banks, or post offices etc annually.

- It assists qualifying taxpayers to control their finances more conveniently by lowering TDS on interest income.

Key Features of Form 15H

A declaration form, Form 15H, helps senior citizens to avoid TDS deduction on interest income. Key features are:

- Eligibility is only for residents aged 60 years or older.

- For a total income of less than ₹3 lakh (₹5 lakh in case of super senior citizens), it can be filed.

- PAN details are required while filing.

- It has to be submitted to banks, post offices, or EPFO etc every fiscal year.

- It ensures that senior citizens get their full interest earnings without having too much TDS withheld.

When Is the Right Time to Submit Form 15G or 15H?

The ideal time to submit Form 15G or Form 15H is at the beginning of the financial year. This ensures that TDS is not withheld from interest income during the year by banks, post offices, or EPFO. Early submission minimises the requirements of refund claims at the time of filing an ITR and keeps cash flow smooth. Each year, when their aggregate income falls below the notified exemption limit, such taxpayers need to file these forms along with their PAN details.

How to File Form 15G and 15H Online?

Online submission of Forms 15G and 15H is convenient and ensures hassle-free filing. Key steps include:

- Upload Form 15G and Form 15H on the online income tax portal quarterly

- Provide the ‘sequence number’ (Field ‘a’ of UIN) against the relevant transaction mentioned in Form 15G and Form 15H

- Visit https://www.incometax.gov.in/iec/foportal/

- Select ‘e-file’ and ‘Prepare & Submit Online Form (Other than ITR)’

- Choose FORM 15G/FORM 15H (Consolidated) to create the XML zip file.

- You will have to add the DSC(Digital Signature Certificate) for filing the forms. You can generate the same through the DSC Management Utility

- Use your TAN and login to the online income tax portal

- Navigate to e-File -> Upload Form 15G/15H

- Choose the form name, financial year, relevant quarter and the type of filing

- Validate the details and attach the ZIP file with the digital signature

- Click Upload to complete the process

How to Check Your Filing Status Online?

Verifying the filing status of Form 15G and 15 H online is easy and guarantees your submission to be successfully accepted. You can do this as follows:

- Go to My account → View Form 15G/15H.

- You will be able to see the uploaded forms which would be processed and validated

- After validation, you will be able to see the status as “Accepted” or “Rejected” within 24 hours of uploading the form.

- if accepted, the forms would be sent to CPC-TDS

- If rejected, the reasons for the same would be show and you can upload the correct form.

By viewing your status online, you can remain informed and avoid making any mistakes in TDS deductions throughout the year.

Key Points to Keep in Mind While Filing Form 15G & 15H

While submitting Form 15G & Form 15H, certain major points need to be followed to ensure precision and to avoid rejection:

- Both these forms are for a period of a single financial year and need to be submitted annually.

- A valid PAN is required; otherwise, the form will not be valid.

- Form 15G can be used by those below 60 years, HUFs, and trusts.

- Senior citizens (60 years and above) alone can use Form 15H.

- To be eligible to claim the TDS deductions, the total income should be less than the basic exemption limit.

- Submit at the beginning of the financial year to prevent premature TDS deductions.

- Always retain an acknowledgement or receipt for future purposes.

- False statements may attract penalties under the Income Tax Act.

By keeping the above in mind, you can submit Form 15G & Form 15H properly and prevent unnecessary TDS deductions.

What Happens If You Forget to Submit Form 15G or 15H?

Delay in filing Form 15G & Form 15H can lead to deduction of unwanted TDS from your interest income. Even though you may claim the refund at the time of income tax return, it is a time-consuming process and could impact your cash flow in the financial year. Early filing of these forms prevents eligible taxpayers from paying excess deductions at source and facilitates easier financial planning.

Here's what happens if you are late in submitting Form 15G or Form 15H:

- Institutions or banks will deduct the TDS on interest income above the threshold amount.

- You can claim the refund while e-filing your ITR, but only after your assessment is completed.

Filing Form 15G & Form 15H in due time prevents deductions and enables tax compliance without hassles.

Key Takeaways

- Form 15G & Form 15H are declaration forms under which eligible taxpayers can save TDS deductions if their income is not above the basic exemption limit.

- Form 15G is for residents aged under 60 years, HUFs, and trusts, or any other person except a trust or a company if the estimated income for the relevant financial year is below the threshold limit.

- Form 15H is specifically for senior and super senior citizens aged 60 years and above if their total income in the financial year has nil tax liability.

- These forms are eligible for just one financial year and need to be filed every year, preferably at the start of the year, to avoid unnecessary TDS deductions.

- Valid PAN is / or for filing these forms and ensures banks or financial institutions are prevented from deducting TDS on eligible interest income upon verification.

- Failing or delaying to file Form 15G & Form 15H results in TDS deductions, which can be recovered later only by way of income tax return refunds, impacting annual cash flows.

- Filing online is easy—log in to your bank's net banking site, enter details, submit, and check status under Tax Services/Form 15G & Form 15H section.

Conclusion

In summary, Form 15G & Form 15H are important to assist taxpayers in exempting tax deducted at source (TDS) on interest income. Filing form15g and 15 h form prevents people, particularly those earning less than the taxable limit, from unnecessary deductions and ensures smoother cash flow. Since these forms are only acceptable for a financial year, punctual submission is vital to avert inconvenience while claiming the refund. By comprehending the eligibility, benefits, and filing process of 15 g 15 h, taxpayers can effectively deal with their tax liability and gain more financial convenience.

An ISO 9001:2015

An ISO 9001:2015