For example, say Mr. Sharma buys a term plan for his life. He chooses a sum assured of Rs.50 lakhs and a policy term of 30 years. After 10 years, he dies due to an accident. In this case, the family will receive Rs.50 lakhs as the death benefit on Mr. Sharma’s death subject to terms & conditions specified in the policy.

It guarantees* the sum assured on the insured’s demise during the term of the policy, provided all due premiums are paid. As such, if the insured dies prematurely, the family is compensated for any financial loss that they may have suffered, to the limit of sum assured under the plan. They might meet their lifestyle needs and also might fulfil their financial obligations/goals even when the breadwinner is not around. This brings out the term insurance meaning and makes it an important component of your portfolio for emergency planning.

What are the Types of Term Insurance?

Now that you know what is term insurance, here’s a look at the different types of term plans that are available in the market.

Type | Term plan meaning |

Level term insurance | Under this type of plan, the sum assured remains constant throughout the policy term. If the life insured dies during the policy term, the insurer pays the sum assured and the plan terminates. |

Increasing term insurance | Under this type of plan, the sum assured increases every year. If the insured dies during the policy term, the increased sum assured at the time of his death is paid, and the plan is terminated. |

Decreasing term insurance | Under this term plan, the sum assured reduces every year on a pre-defined basis. If the life insured dies during the policy term, the reduced sum assured at the time of his death is paid, and the plan is terminated. |

| Term Plan with a return of premium

| This term plan has a maturity benefit and is, different from other plans. Under this plan, if the life insured dies during the policy term, the sum assured is paid. However, if the insured survives the policy tenure, the premium paid after deducting applicable taxes is refunded back as a maturity benefit, provided all the premiums of the plan are duly paid. |

How do term plans work?

To understand what is term plan you need to understand how it works.

When you buy a term plan, you choose the following details of the cover -

- The sum assured

- The coverage duration

- The premium paying tenure

- The premium paying frequency

Based on some of the factors such as, your age and other risk factors, the premium is determined.

You pay the calculated premium for the chosen premium paying term and frequency and enjoy the plan’s coverage.

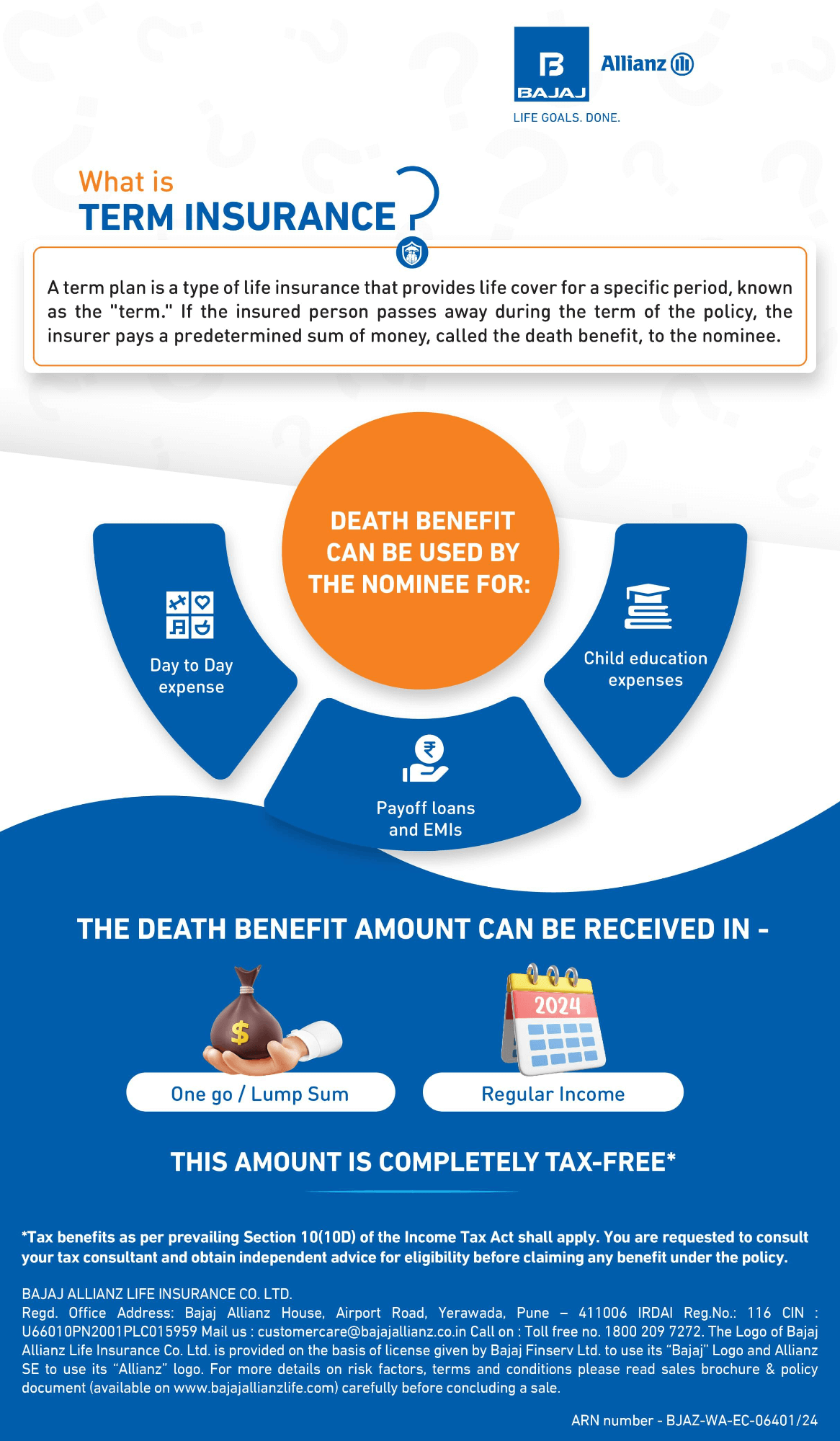

If the life insured dies during the policy tenure, the insurer pays the sum assured under the plan as the death benefit. This benefit is paid in a lump sum or in instalments as selected by the life insured while buying the policy depending on the terms and conditions of the plan.

How to Choose a Term Insurance Plan?

Now that you know what is a term insurance plan you might have also understood its importance. When you look to buy the plan, there will be multiple options for you to choose from. In order to get a suitable policy based on your coverage needs, here are some factors that you may consider:

● Type of policy

First, determine the type of policy that suits your needs. As mentioned earlier, there are different types of term plans. Assess these plans and choose one that matches your coverage needs.

For instance,

- If you want uniform coverage throughout the policy duration, choose a level term plan

- If you want the sum assured to increase with your increasing financial responsibilities, you can opt for an increasing term plan

- If you have a loan, for example, and you want a plan to cover the reducing balance of the loan, you can choose a decreasing term plan

- If you are looking for maturity benefit too, a term plan with return of premium option will be the most suitable one.

● The Sum Assured

Having optimal coverage is essential for financial security. So, opt for a suitable sum assured. To assess suitable sum assured, you can use term insurance calculators, that are available online. These calculators help you estimate the optimal sum assured so that you are optimally insured, and your family gets the required financial assistance in the case of emergencies.

● Optional riders

Term insurance plans allow a range of optional riders to enhance coverage, on payment of additional nominal premium. For instance -

- The Accidental Death Benefit rider pays an additional financial coverage in case of accidental deaths during the policy term

- A critical illness insurance rider offers financial coverage in case the insured person is diagnosed with any of the illnesses covered.

- The Waiver of Premium Benefit Rider ensures that all future premiums are waived off if the insured person is unable to pay them due to accidental permanent disability or a critical illness diagnosis.

So, basis your coverage needs, choose the suitable riders and enjoy a wider scope of coverage on payment of additional nominal premium.

● Claim Settlement Ratio

The Claim Settlement Ratio (CSR) defines the percentage of claims the insurance company has settled against the total claims received by it in a financial year. The higher the ratio the better is the probability that the insurance company will make the claim settlements. So, compare the CSR of different insurers and you may opt for the one that has a high ratio.

● Premium v/s Coverage

The suitable term insurance policy will be the one that offers an inclusive scope of coverage as per your needs at affordable premium.

Understand what is term insurance, how it works and its importance. Use the aforementioned parameters and buy a suitable policy that matches your coverage needs. Secure yourself and your family financially against unforeseen eventualities.

BJAZ-WEB-EC-02309/23

An ISO 9001:2015

An ISO 9001:2015