Overview of Term Insurance Coverage

A term insurance policy is a protection-oriented life insurance plan. It covers the risk of premature demise and pays a death benefit if the life-assured passes away. If the life assured is the breadwinner of the family and if the family depends on him for their financial needs, a term insurance policy can provide financial assistance to the family in the absence of the life assured.

Given the financial security that they offer, term insurance plans are a good addition to your portfolio. But, have you ever wondered how to decide the term insurance amount?

An optimal term insurance coverage is needed for complete financial security. If the coverage is low, the family may not get the financial assistance that they need. The limited benefit would take care of only some of the needs rendering the purpose of the term plan ineffective. That is why, choosing the right coverage is important.

How Do I Calculate How Much Term Insurance I Need?

How much term insurance should I take?

This is a common question that many individuals might face when buying a term insurance policy. To answer this, there are various methods that help you determine the right coverage amount.

Here’s a look at some of the calculation methods that you can use to find the right term insurance amount –

1. The basic method

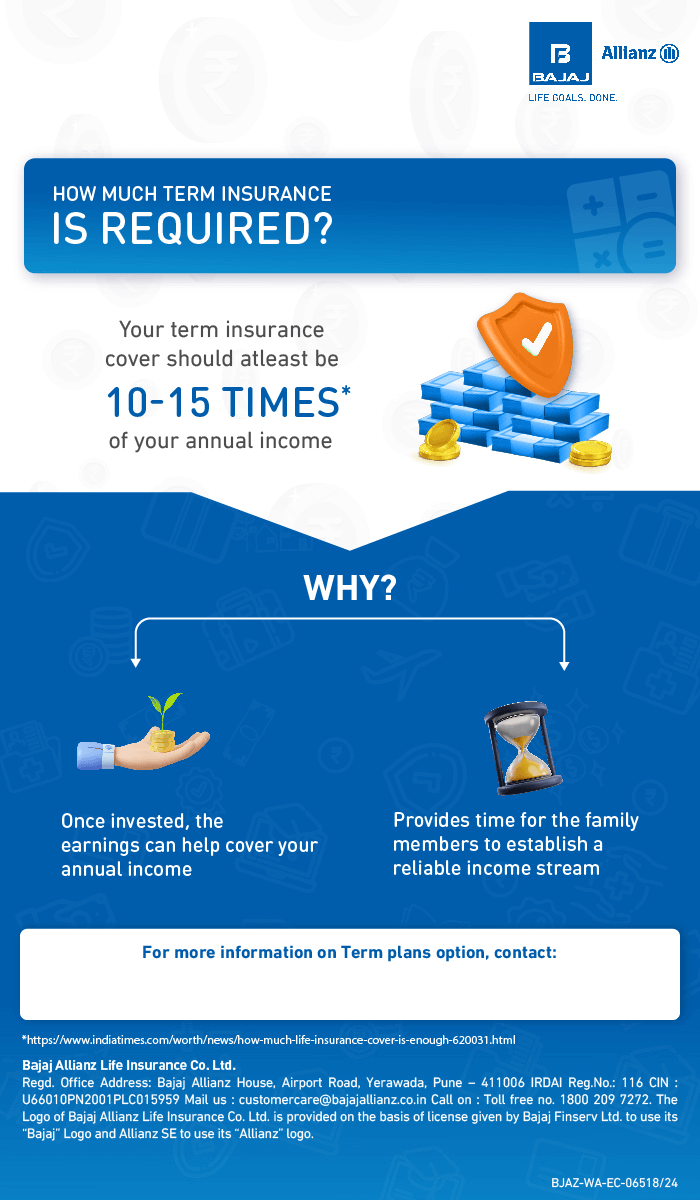

This is one of the most commonly used and basic methods of calculating the term insurance amount. Under this method, the optimal sum assured is calculated as 10 to 12 times your annual income1.

2. Underwriters’ Thumb Rule

This method is also similar to the aforementioned method with a slight variation. In this method, the multiple of the income depends on your age. When you are young, the multiple is high and as you age, the multiple reduces1.

Here’s a look at the different multiples at the different age brackets1 –

| Age bracket | Multiple of the annual income |

| 20 to 30 years | 15 |

| 31 to 40 years | 14 |

| 41 to 45 years | 12 |

| 46 to 50 years | 10 |

| 51 to 55 years | 8 |

| 56 years and above | 6 |

For instance, if an individual is aged 30 years with an annual income of Rs.10 lakhs, the right sum assured would be Rs.1.5 crores. On the other hand, if an individual is aged 35 years and has the same annual income of Rs.10 lakhs, the ideal sum assured would be Rs.1.4 crores.

3. Human Life Value (HLV)

Another commonly used method to determine the right coverage is the HLV method. Under this method, the value of human life is estimated by considering the income that the individual generates1.

For instance, say an individual generates Rs.5 lakhs in annual income. This means that his family expects to get Rs.5 lakhs from him as long as he works. If the individual passes away prematurely, his family would lose this income of Rs.5 lakhs. Thus, the individual needs to make a provision to keep the income continuing even in his absence. If the risk-free rate of return is considered to be 6%, a corpus of Rs.83,33,333 can generate an annual income of Rs.5 lakhs. So, the right term insurance coverage would be Rs.83,33,333.

You can use any of these methods to find out the coverage that you need. Alternatively, you can use term insurance calculators available online with most insurance companies to calculate the coverage needed. Enter a few details in the calculator and calculate the recommended coverage online in a few minutes.

How Does Term Insurance Coverage Work?

Under a term insurance policy, you choose the –

1. Type of policy

2. Sum assured

3. Policy tenure

5. Premium paying frequency

6. Optional riders or coverage options (if available)

Based on these choices, your age and other risk factors, the underwriting team determines the premium. You need to pay the premium over the chosen premium-paying tenure and in the chosen frequency and you get covered under the plan.

If the life assured passes away prematurely during the chosen policy tenure, the death benefit is paid. On the other hand, if the life assured happens to survive the entire policy term and the life insurance policy matures, there is no benefit paid. However, if you have chosen the return of premium term plan or if the return of premium option is chosen under the term plan (if available), the premiums paid over the policy tenure would be refunded.

This is how the term insurance coverage works.

Factors That Impact the Size of the Coverage

Now that you know how to decide the term insurance amount, know the factors that impact the size of coverage. Some such factors are as follows -

1. Age

Under many calculation methods, the coverage depends on your age. If you are older, lower coverage is needed and vice versa. So, the age at which you buy the term insurance policy greatly affects the sum assured that you need.

2. Family expenses

The higher the expenses the higher the coverage that you would need to provide your family with an optimal financial corpus to meet their expenses.

3. Riders

Riders are optional coverage benefits that can be added to your base policy on payment on nominal additional premium. Riders have a separate sum assured and can help you determine the sum assured needed in your term plan.

4. Children's education

If planning for your children’s higher education is one of your financial goals, you would need a higher corpus to fulfil this goal.

5. Term insurance premiums

Term insurance premiums also affect the sum assured that you choose. The premiums depend on the coverage. If you choose a higher coverage the premiums would also be high and vice-versa. As such, it is important to assess if the premiums are affordable for the coverage selected. If higher coverage means unaffordable premiums, premium payments might become a financial strain and the coverage might lapse. As such, affordable premiums are important.

6. Important life goals

Your life goals also determine the coverage needed. If you have multiple goals for which you would need funds, you need a high sum assured. On the other hand, if most of your goals are met, the requirement of the coverage reduces.

Things to Consider While Calculating Your Term Insurance Cover

Some of the things that should be considered when calculating your term insurance coverage are as follows –

1. Number of dependents

If you have multiple dependents depending on you for their financial needs, you need a higher coverage level which would be optimal enough to cover their needs in your absence.

2. Inflation

Inflation means a general rise in the price of goods and services. Inflation is a common phenomenon which increases your household expenses with each passing year. Moreover, the corpus needed for your financial goals also increases if you factor in inflation. Thus, your coverage should be sufficient to cover the inflated cost of living and financial goals.

3. Existing and prospective liabilities

If you have existing liabilities, you would need additional coverage which can cover your liabilities when you are not around. Moreover, if your liabilities are expected to increase in the future, your coverage should be optimal to account for the expected liabilities too. For instance, if you have an existing car loan or personal loan, add them up to your sum-assured calculation. Moreover, if you might take a home loan in future, factor in the loan when calculating the sum assured.

4. Existing investments

If you have savings and investments in Full Name, you can reduce their value from the required sum assured.

5. Existing coverage

If you have bought life insurance policies, you can deduct their sum assured from your coverage requirement to find the exact coverage needed.

Conclusion

Don’t just buy a term life insurance policy. Buy a policy which has optimal coverage to provide complete financial security to your family in your absence. This would give you complete peace of mind and may help your family in their worst times. Do a complete fact-finding analysis when buying term insurance. Assess your existing expenses, liabilities, income, investments, assets, etc. and use any of the methods to calculate the right term insurance coverage.

FAQs

1. Should I consider my outstanding debts when calculating coverage needs?

Yes, you should consider your outstanding debts when calculating your coverage needs. The outstanding debts are financial liabilities which should be added to the calculated sum assured to find the right coverage amount.

2. What is income replacement, and how does it factor into coverage calculations?

Income replacement means replacing the income that the family loses if the life assured passes away. Income replacement is one of the methods of calculating term insurance coverage amounts. Under this method, you multiply the annual income of an individual with the expected years of active employment to get the ideal coverage amount.

For instance, an individual earning Rs.25 lakhs every year aged 50 years and likely to retire at 65 years has an active working life of 15 years. If he passes away, his family would lose an aggregate income of Rs.3.75 crores (Rs.25 lakhs X 15 years). So, a coverage of Rs.3.75 crores is needed to replace the lost income.

3. How to determine the duration of term insurance?

When determining the duration of term insurance, the longer the coverage the better. This is because term plans cover the risk of premature demise only during the chosen tenure. If the life assured passes away after the tenure has expired, no benefit is paid. Thus, it is better to choose a longer tenure so that the life assured is covered for a longer time.

You can choose the whole life option which is offered with many term plans. Under this option, coverage is extended till 99 or 100 years of age so that you can get covered lifelong and enjoy maximum financial security.

An ISO 9001:2015

An ISO 9001:2015