Today, due to better availability of medical care, affluence and increased life expectancy, especially in urban India, it’s not uncommon to see retirees living up to the age of 90 years. Therefore, when you start to build your retirement savings corpus, you have to consider this possibility and plan accordingly. Some people, due to faulty retirement planning, miscalculate the required size of their retirement corpus and suffer unnecessarily in the golden stage of their lives. You can avoid such mistakes by taking some proactive steps early on in your life.

What is retirement savings?

If you have ever asked yourself this question "How much do I need to save for my retirement to live a comfortable life?", then you know what retirement savings is.

It’s the amount of wealth that you have generated through various savings and investment schemes to meet your retirement life goals. The quantum or size of your retirement corpus is directly proportional to the duration of your retirement life.

For example, if you plan to retire early in your life. Let's say that you want to retire at the age of 50 years – 10 years before conventional retirement age – then your retirement life will be longer. If you live until 90 years, you will have to ensure that your retirement fund is large enough to sustain you for 40 years.

Avoid Common Mistakes In Calculating Ideal Retirement Corpus

There is no lack of good retirement plans in India that ensures to take good care of you and your spouse post-retirement. However, you have to avoid these common mistakes so that your retirement savings corpus is adequate.

• Not factoring in inflation

It’s almost an obvious thing to do when you are planning for retirement but many people forget keeping inflation in mind while calculating the retirement fund. You may think that a pension of Rs. 50,000 may be enough to meet your expenses after retirement but you may be wrong.

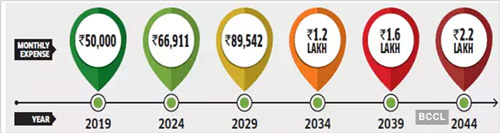

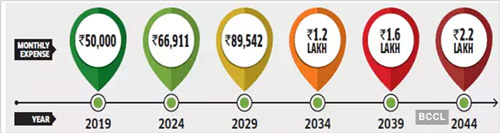

If your current expenses are Rs. 50,000 per month, then a slight inflation rate of 6% will push your monthly expenses to Rs. 1.6 lakh in 20 years. That’s a huge shortfall of Rs. 1.1 lakh. Not bringing inflation into the equation could be your biggest mistake.

Rise in Monthly Expense at 6% Yearly Inflation Rate

Source: Economictimes.indiatimes.com[1]

• Not keeping it separate from other life goals

Ensure that you have an investment plan to reach your financial goals. Your retirement savings corpus should be kept separate from your other life goals such as children’s higher education, marriage, world travel, etc.

Mixing various financial goals into one place can lead to miscalculation and you may end up with a shortfall. Remember that retirement planning is not something that you can accomplish on the family dining table. If you are not sure, take help of a wealth advisor who will create a goal-based investment plan for you.

• Starting late

Whether you want to retire in your 60s or your 50s, you need to start early to build a significant retirement corpus. Many people start late and have no idea how to reach their retirement savings goal. It may lead to miscalculation and risky investments for aggressive returns leading to huge losses.

For instance, if you are investing in a ULIP or annuity plan, you can maximize your savings with the power of compounding. Starting early also helps you get better returns on investment due to longer duration. Therefore, don’t make the mistake of procrastinating and starting late in investing for retirement.

• Boilerplate approach

Avoid a boilerplate “one-size-fits-all” approach when it comes to calculating your retirement savings corpus. Calculating the size of your retirement fund must be based on your liabilities, expenses, current age, risk profile and retirement age and will vary for each individual. Don’t pick any random figure or investment product; make sure that your retirement planning is robust and your calculation will be spot on.

A few tips on how to calculate retirement corpus correctly

Here are a few expert tips that you can use to calculate your retirement savings correctly:

• Ensure that you have 60-80% of your pre-retirement monthly income after retirement if you plan to retire in your 60s. That percentage will increase if you plan to retire earlier.

• Make sure that returns on investments are able to beat inflation. Assume that yearly inflation rate is between 4-6%.

• Calculate your current expenses but consider increased healthcare expenses and costs in the future.

• Use the formula: Corpus size = (Monthly expense x 12) x 100 / 7*

*Rate of return

Finding the right retirement plans in India to invest

Once you have arrived at the right amount, the next step is to find the right retirement plans in India to invest. Unit linked insurance plans (ULIPs) and pension plans are preferred option for retirement savings and investment. ULIPs help you grow your wealth with market-linked returns while offering you and your family with insurance protection.

You cannot go wrong on your retirement savings calculation if you avoid these common mistakes. Make sure you follow the tips mentioned above to enjoy your golden years in peace, comfort and happiness. Proper retirement planning ensures that you don’t have to compromise on your lifestyle and life goals even after retirement.

ISO/IEC 27001:2022 Certified

ISO/IEC 27001:2022 Certified