If you have 35 years to save for normal retirement, you just have 15 years to plan for early retirement. From a financial perspective, when you opt to retire early, you extend the post-retirement spending phase and shorten the earning phase. Conventional retirement planning has some tried and tested methods like investing in a pension plan and living modestly. Though early retirement requires radical measures, one has to mix it with some tools of conventional retirement planning such as investment in pension plans.

Let us consider three ways that can help to achieve early retirement goals.

1. Build Assets Faster

Conventional retirement planning is based on the adage ‘slow and steady wins the race’. It uses traditional financial strategies such as saving and passive investing. It propagates contributing to provident funds or investing in mutual funds. One should invest in a retirement fund or contribute to provident funds, but relying solely on these tools will not help you achieve your retirement goals early. Conventional measures work fine when you have a longer time period and need a smaller retirement corpus.

Taking into account the finer points of long-term investing will throw some light on why it may not be the ideal strategy if one decides to retire early. With long term investing, you contribute regularly, which is generally invested in stocks or bonds to create financial assets. If you consider inflation while calculating long-term returns from various assets, it may come around mid-single digits. It is a decent rate of return, but may not be enough to build adequate assets for you to retire early. Moreover, market-linked investments perform well in the long-term but may give low returns in shorter periods of 5-10 years. Since you have a small investment time frame of 15 years, relying solely on traditional retirement tools may not be a wise decision.

One of the ways to achieve early retirement goals with traditional retirement planning strategies would be to inculcate a good savings habit which could help you in the future. Pursuing extreme frugality will ensure saving over 70% of your income for retirement. You will have to cut down your expenses to a bare minimum. It can be done to achieve retirement goals early, but it is not everyone’s cup of tea.

The other alternative to accelerate asset creation for early retirement is active investing. As opposed to just passive investing, you can add a skill component to your investing strategies to boost returns. Just like other tasks in life, when you give proper attention to investing, you will get better results.

Besides active investing, you can leverage your resources to involve more people and achieve the retirement goal in less time. The biggest limiting factor in early retirement is the time available for financial preparation. Leveraging means using resources to nullify the impact of time. Now, you either live extremely frugally, start investing actively or opt for leveraging to build assets for early retirement.

Living frugally in your prime years can be difficult and so is active investing. One requires specialized knowledge of personal finance and investing skills to actively manage an investment portfolio. Two of the easier ways to use leverage is to invest in real estate or business ownership.

One should keep in mind that all the strategies come with some inherent risks, so it should be applied as per your risk profile and in combination with traditional retirement planning tools like pension plans. There are three types of assets and different financial strategies will create a different type of asset. There are paper assets, real assets and business. Passive investing will create paper assets. To achieve your retirement goals early, you will have to accelerate the process of asset build-up, which can be achieved by active and leveraged investment strategies.

2. Take Inflation into Account and Try to Beat It

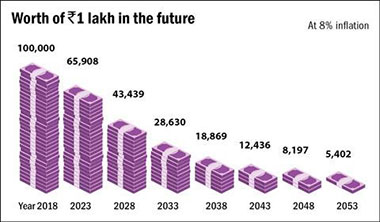

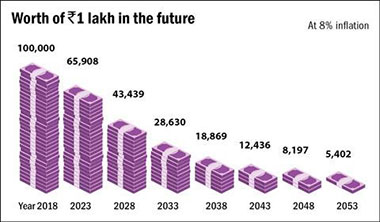

Building a fort is not enough, you have to protect it with ramparts and moats. Similarly, creating assets for early retirement is not enough, you have to make it inflation-proof. Inflation silently erodes the purchasing power of your retirement corpus. In absolute terms, there won’t be any impact on your retirement savings, but in real terms, you will be able to buy less from the same amount of money after a few years. The inflation rate is relatively high in developing countries like India. The Reserve Bank of India has been mandated to maintain the inflation in 2%-6% band, and the inflation generally hovers around 4%. But it can rise beyond the upper limit of the band and even if it remains near the middle of the band, it can do substantial harm to your savings.

Inflation is more dangerous for early retirees as the post-retirement spending period is long, which gives inflation more time to erode the value of retirement savings. A mere inflation rate of 4.5% will reduce your purchasing power by half in 16 years. It means you will have to double your retirement savings in 16 years just to maintain the level of purchasing power you started with. With rising life expectancy rates, one of the spouses can expect to reach the late 80s. Now, if you retire at 40, an inflation rate of 4.5% can cut your retirement savings in half i.e. up to three times during your retirement.

Source: Valueresearchonline.com

To beat inflation, you will have to first acknowledge it. While planning for early retirement, always take into account inflation-adjusted returns. If you look at the nominal returns and plan your retirement, you may miss the mark and may even outlive the retirement corpus. Invest in instruments that boost returns mid-way through the investment and help in beating inflation. For instance, small policy bonuses or cash bonuses which are inbuilt in some of the ULIP plans can increase the value of the policy. Small bonus additions can make a substantial difference over the long term. Along with products, inflation also affects services like medical care, etc. To guard against medical inflation, you can buy a health insurance policy. You can also opt for critical illness rider along with your insurance plans, which will provide an additional financial cover in case of medical emergencies.

One should try to protect against inflation as efficiently as possible. Opt for insurance plans or investments that compensate for inflation. For instance, there are life insurance policies that increase the cover according to life cycles. Inflation erodes real wealth and hence, long-term investors should be extremely wary of it. If you want to achieve your retirement goals early, diversify your resource allocation and income sources in a way that the growth offsets the impact of inflation. Rental income from real estate can be an example as it increases by a fixed percentage every year or years, which helps in taking care of inflation.

3. Ensure perpetual income while protecting the principal

The truth about financial planning is that it is a ‘plan’ based on a number of ‘variables’. The most important variable is the age of the retiree. Even though one may prepare a financial plan to the best of his/her abilities, he/she will never be able to predict the final age. Retirement corpus has two components—the interest and the principal. In the initial phase of retirement, the interest generated is sufficient to take care of your daily needs, but as time progresses, due to inflation and other factors, the interest income may not be enough to take care of all your needs. When the interest income falls short, the principal amount automatically gets utilized.

To avoid the specter of outliving your retirement savings, you will have to ensure that the principal amount remains intact while you have a perpetual stream of income. A pension plan that provides a whole-life coverage option can be a partial solution. It will ensure that you receive a regular amount for the entire life. However, inflation could be an issue and hence you will have to think beyond just investing in a pension plan. Planning for early retirement with a perpetual income is easy, though the implementation could be slightly tricky.

First, build an investment portfolio that generates residual retirement income which is more than your personal expenditure. You may invest in a variety of fixed-income instruments along with real estate for rental income. You can use the residual income generated by the portfolio without having to touch the actual assets. If the residual income fulfils your personal expenses, you will never be able to outlive your retirement assets.

Building an investment portfolio with adequate residual income is half the task, the other half is to manage it actively to beat inflation. With active management, you will have to ensure that the rate of growth of the assets is higher than the inflation rate.

If you build an inflation-proof investment portfolio, the third step should be to diversify it. The perpetual income should come from different sources of income that are not related to each other. Diversification is a basic rule for all financial planning strategies. Invest in a variety of assets that have a negative correlation with each other. It will ensure that your perpetual income is not dependent on the performance of one asset. If an asset faces headwinds, you will have income from other assets to fall back on. A mixture of dividend-paying stocks and real estate income would suffice. You can also add a protective layer of pension plans and provident funds to reinforce the income from other sources.

Conclusion

Before retiring, ensure that you have created a perpetual source of income that generates more money than your personal expenses. Live on the income from your passive and active investments for a couple of years before retiring early. It will bring the flaws in your retirement planning and will save you from surprises in the future. One should also focus on the psychological aspect of early retirement along with the financial aspect. Adequate financial resources are not the end; they are just the means for early retirement. The freedom, relaxation and leisure will be meaningful only for the first few days. Take up hobbies and some other activities that give you satisfaction. Many people take up part-time consulting or coaching jobs, which also open up an alternate source of retirement income. In a nutshell, financial planning for early retirement is just the medium, there should be a compelling reason to opt for it.