What is life insurance penetration?

Life insurance penetration is an important metric that measures the development and adoption of life insurance in India1. It is one of the ways of measuring how many people buy life insurance in India. Life insurance penetration is calculated as a percentage of life insurance premium to the overall GDP (Gross Domestic Product) of the country1.

As the GDP and the premium collected change every financial year, the rate of penetration is calculated for each financial year. The data is then studied to find out how life insurance is progressing. A higher rate shows that life insurance is reaching a higher percentage of the population.

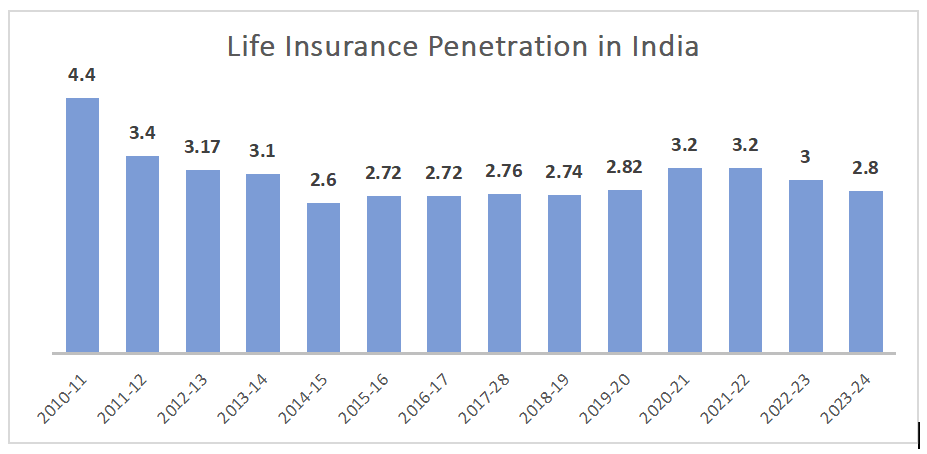

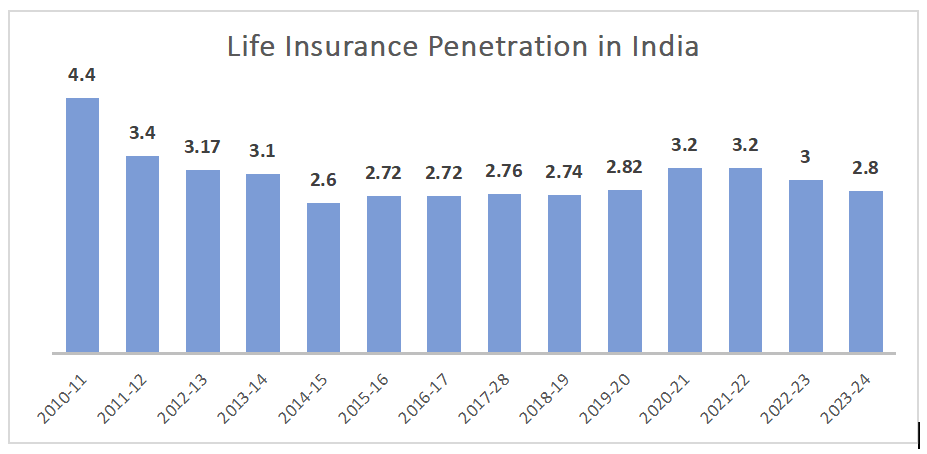

Life Insurance Penetration in India

After the life insurance segment was liberalised in 2000 and private players were allowed to operate and sell, the life insurance penetration has seen steady growth till the financial year 2009-102. In the financial year 2001-02, life insurance penetration stood at 2.15%2, which grew to 2.59%2 the next year and reached 4.60%2 during the financial year 2009-10. Here’s a look at how insurance penetration has performed over the years2,5 –

What Does Life Insurance Penetration Means for a consumer?

As a consumer, life insurance penetration does not affect your coverage. However, it does impact how the life insurance industry innovates or reacts to the numbers.

Some of the reasons why insurance penetration may be low are as follows3,4 –

- Lack of awareness about the importance of insurance

- Incomplete understanding of life insurance products

A low life insurance penetration rate might urge insurers to work towards increasing insurance penetration and insurance awareness among people.

As insurance companies may innovate their products and offer more benefits, customers might get better life insurance plans at affordable premiums. For instance, nowadays, many plans come with inbuilt riders for additional protection.

So, understand what life insurance penetration is all about and how it is performing over the years.

FAQs

Is life insurance becoming more accessible in rural India?

Yes, with the rise of digital platforms, micro-insurance products, and government-backed initiatives, life insurance is gradually becoming more accessible in rural and semi-urban areas.

How can higher life insurance penetration benefit India’s economy?

Increasing life insurance penetration can have a wide-reaching impact. It helps:

- Strengthen a family’s financial stability

- Encourage long-term savings and investment habits

- Channel funds into capital markets

- Encourage economic independence through the gradual reduction of dependency on government-administered social support systems.

An ISO 9001:2015

An ISO 9001:2015