*Tax benefits as per prevailing Section 10(10D) and Section 80C (under old tax regime) of the Income Tax Act shall apply. You are requested to consult your tax consultant and obtain independent advice for eligibility before claiming any benefit under the policy

Bajaj Allianz Life Insurance Company Limited, Bajaj Allianz Life eTouch II, Bajaj Allianz Life New Critical Illness Benefit Rider and Bajaj Allianz Life Family Protect Rider are the names of the company and the product/rider respectively and do not in any way indicate the quality of the product/rider and its future prospects or returns. For more details on risk factors, terms and conditions please read sales brochure & policy document of base product and rider carefully before concluding a sale or consult your “Insurance Consultant” for more details and eligibility conditions. Bajaj Allianz Life Superwoman Term comprises of Bajaj Allianz Life eTouch II – Life Shield variant (UIN:116N198V04) a Non-linked Non- Participating Individual Life Insurance Term Plan, Bajaj Allianz Life New Critical Illness Benefit Rider – Comprehensive option (UIN: 116B058V01) a Non-Linked, Non-Participating, Individual, Pure Risk Health Rider (this is a mandatory rider) and Bajaj Allianz Life Family Protect Rider – Child Care option (UIN: 116B056V01) - a Non-linked, Non-participating, Individual, Pure Risk Health Rider (this is an optional rider).

Bajaj Allianz Life eTouch II is also available individually for sale without the riders or with the other available riders options under the base policy.

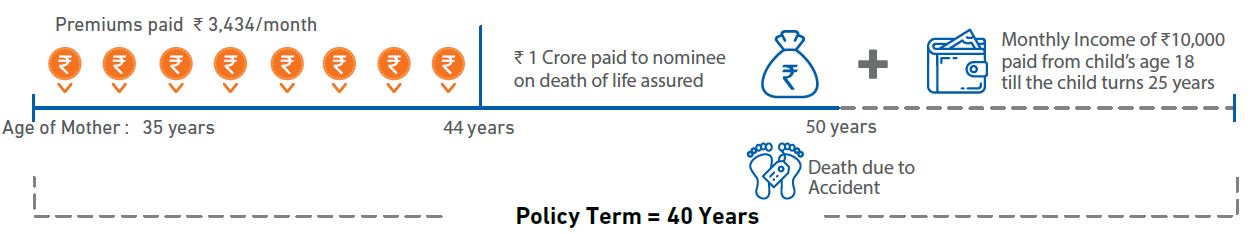

***Available with Bajaj Allianz Life Family Protect Rider – Child Care option - A Lumpsum benefit equal to 105% of Total premiums paid4 w.r.t rider will be paid on the earliest occurrence of death or Accidental Total Permanent Disability, plus a monthly income as a percentage (0.1% to 0.5%) of Rider Sum Assured as opted at inception will be paid until child turns Age 25. 4Total Premiums Paid: Total Premiums paid till date w.r.t. the rider option shall be the total of all premiums received under the rider option chosen, exclusive of taxes, extra premium w.r.t. the rider, if any. This is an optional rider.

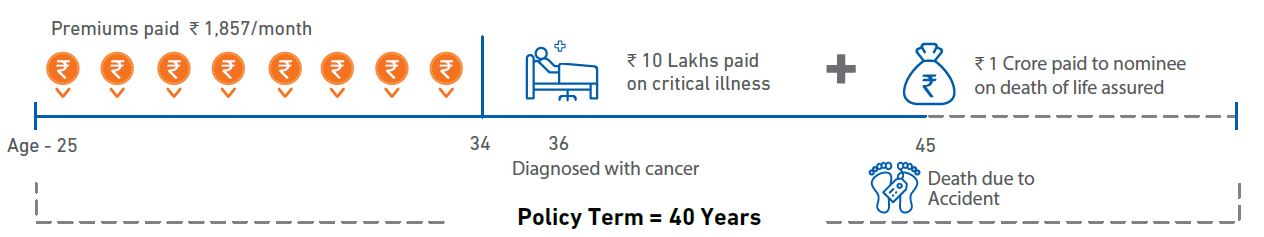

$$Available with Bajaj Allianz Life New Critical Illness Benefit Rider - Comprehensive option (UIN: 116B058V01) - A Non-Linked, Non-Participating, Individual, Pure Risk Health Rider. This is a mandatory rider

1Health Management Services for Women upto ₹ 36,500 per year

Health Management Services for Women

| Frequency

| Cost (₹)

|

|---|

Comprehensive Health Check-Up:

- Cancer Screening

- Diabetic, Thyroid, Lipid profile tests

- Calcium Serum test

- Complete Blood Count test

| 1 per year

| ₹ 3,500

|

OPD^ in-clinic consultations

(Specialist doctors like Gynaecologist, Obstetrician, Dermatologist, Paediatrician, Orthopaedic & General Physician)

^OPD – Outpatient Department

| 1 per year

| ₹ 1,000

|

Pregnancy OPD^ wallet

(OPD^ benefit worth ₹ 2,000 unlocked in case of pregnancy)

| Once during policy term

| Not considered in yearly cost since this is available once during policy term

|

Doctor Insta-Consultations

| 3 consultations per month = 36 consultations per year

| Average cost per session = ₹ 500

Total cost per year = ₹ 500 * 36 = ₹ 18,000

|

Health Coach

(Diet & nutrition consultations)

| 1 consultation per month =

12 consultations per year

| Average cost per session = ₹ 500

Total cost per year = ₹ 500 * 12 = ₹ 6,000

|

Emotional Wellness

(Psychologists consultations)

| 1 consultation per month =

12 consultations per year

| Average cost per session = ₹ 500

Total cost per year = ₹ 500 * 12 = ₹ 6,000

|

Network discounts:

Medicines (M) - 10%

Lab-test booking (L) - 10%

Out-patient consultation (O) - 10%

In-patient consultation (P) - 5%

| Throughout the year

| Assumption – Total

expense on these

services throughout

the year

| Total discounts that can be availed

throughout the year

|

M - ₹ 5,000

| ₹ 500

|

L - ₹ 5,000

| ₹ 500

|

O - ₹ 5,000

| ₹ 500

|

P - ₹ 10,000

| ₹ 500

|

Total per year as per assumption

| ₹ 36,500

|

Note: The above mentioned costs are based on estimated average market price for respective services. T&C apply.

Doctor insta consultations and health coach services are unlimited and the above numbers are assumed only for the purpose of calculation of the yearly benefit.

-Calculator.svg)

An ISO 9001:2015

An ISO 9001:2015