IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER

The Unit Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender or withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of the fifth year.

ULIPs are different from the traditional insurance products and are subject to the risk factors. The premium paid in ULIPs are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. Bajaj Allianz Life Insurance Company Limited is only the name of the Life Insurance Company and Bajaj Allianz Life Smart Pension- A Unit -Linked, Non-Participating Individual Pension Plan (UIN- 116L209V02) is only the name of the unit linked insurance contracts and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the insurance company. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. For more details on risk factors, terms and conditions please read sales brochure & policy document (available on www.bajajallianzlife.com) carefully before concluding a sale.

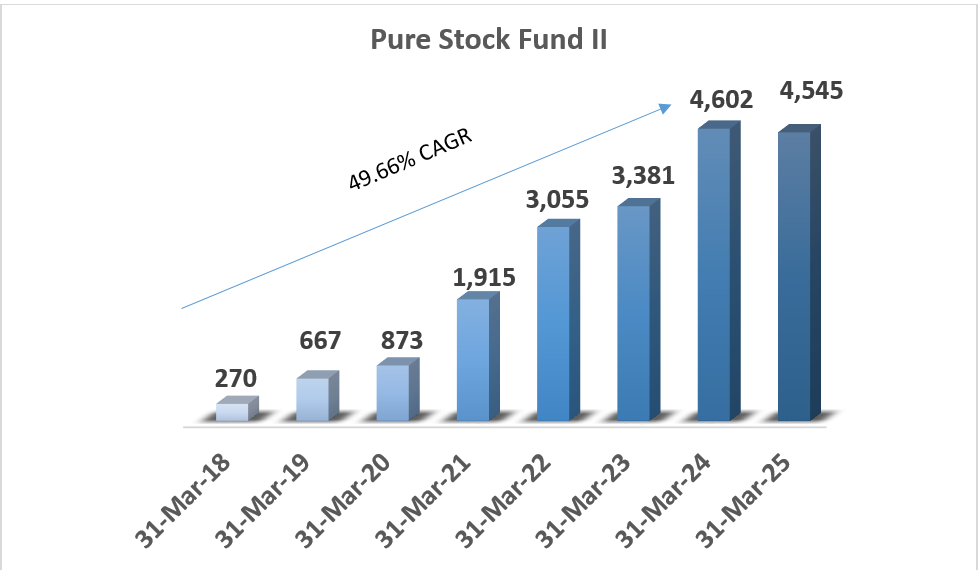

Pure Stock Pension Fund II is available only with Bajaj Allianz Life Smart Pension- A Unit -Linked, Non-Participating Individual Pension Plan (UIN116L209V02)

In addition to other funds, Pure Stock Pension Fund II is now available with Bajaj Allianz Life Smart Pension. Customer has an option to choose from other available funds apart from Pure Stock Pension Fund II.

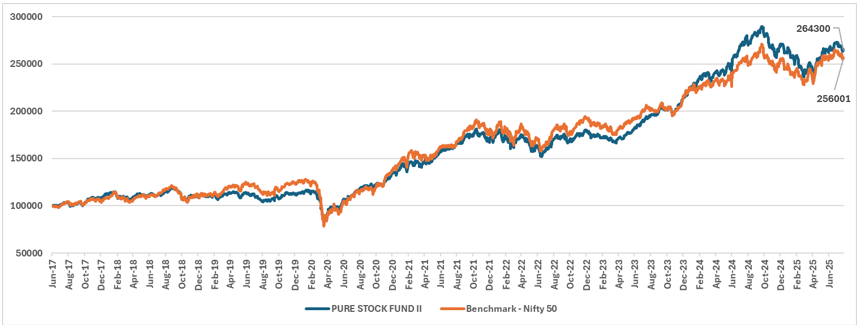

Please note that the fund aims to replicate the performance of benchmark index fund, subject to tracking error.

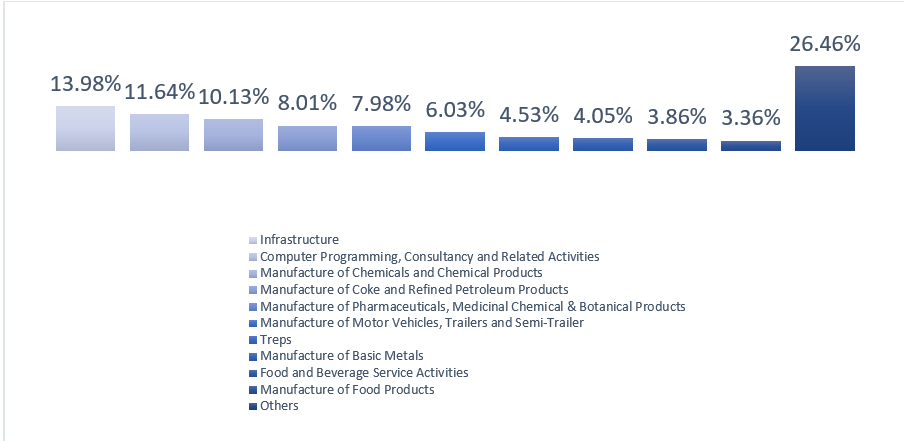

*Sectorial diversification based on fund mandate and IRDA regulation

Past returns of a fund are not necessarily indicative of the future performance of the fund. | Please consult the financial advisor before

-Calculator.svg)

An ISO 9001:2015

An ISO 9001:2015