Bajaj Allianz Life ULIP products with underlying Bajaj Allianz Life – Focused 25 Fund, enables policyholders to achieve their life goals, powered by the security of a life cover and the opportunity for wealth creation.

Benchmark: Nifty 100 Index

SFIN No.: ULIF09606/02/25FOCUSED25F116

Investment Philosophy

- Focus on Growth at a Reasonable Price (GARP)

- Long term orientation in our approach - We invest in a Business and not a “stock.”

- Identify ideas wherein the business opportunity size is large

Research Backed Investments

- We have a team of analysts who follow a bottom-up research process

- We look for companies with strong Competitive Advantage Brand, Distribution reach, Cost Advantage and Barriers to Entry

- Invest in companies with an acceptable level of corporate governance and competent management team

| Performance (in %) as on 31st Jan 2025 |

|---|

| Index | 1Yr | 2Yrs | 3Yrs | 4Yrs | 5Yrs | 7Yrs | 10Yrs |

|---|

| Mutual Fund Focused Category - Weighted Average Return | 13.4 | 20.3 | 10.8 | 15.8 | 15.4 | 12.1 | 12.5 |

| Nifty 100 | 9.1 | 16.9 | 11.1 | 15.0 | 14.8 | 11.3 | 10.6 |

| Nifty 50 | 8.2 | 15.4 | 10.7 | 14.6 | 14.5 | 11.4 | 10.3 |

| Nifty 200 | 9.3 | 19.0 | 12.5 | 16.6 | 16.0 | 11.8 | 11.1 |

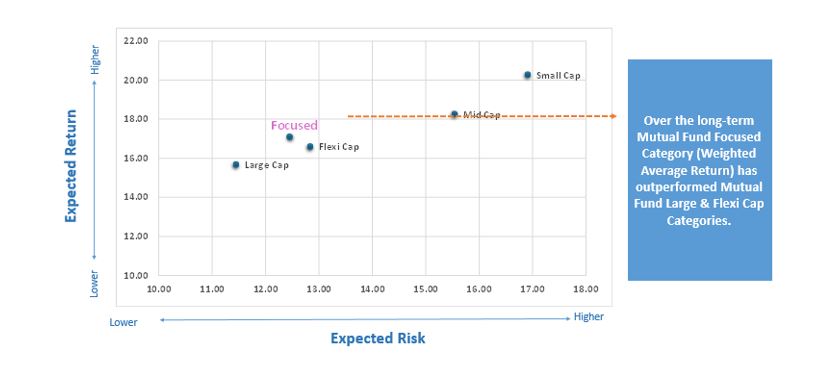

- Mutual Fund Focused Category Weighted Return outperformed other market cap large cap and Large & Mid Cap indices in most of the time periods.

| Index | CY14 | CY15 | CY16 | CY17 | CY18 | CY19 | CY20 | CY21 | CY22 | CY23 | CY24 |

|---|

| Mutual Fund Focused Category Weighted Average Return | 60.4 | 3.7 | 4.7 | 36.7 | -6.8 | 12.1 | 15.6 | 33.2 | -4.5 | 23.1 | 18.2 |

| Nifty 100 | 33.2 | -2.4 | 3.6 | 31.0 | 1.1 | 10.4 | 14.9 | 25.0 | 3.6 | 20.0 | 11.8 |

| Nifty 50 | 31.4 | -4.1 | 3.0 | 28.6 | 3.2 | 12.0 | 14.9 | 24.1 | 4.3 | 20.0 | 8.8 |

| Nifty 200 | 35.5 | -1.9 | 3.7 | 33.4 | -1.0 | 8.7 | 15.6 | 27.5 | 3.6 | 23.5 | 13.6 |

| Source: - Morningstar Direct, BALIC Research. Past performance is not indicative of future performance. |

|---|

- Mutual Fund Focused Category (Weighted Average Return) has significantly outperformed the Nifty 100 index in 9 years out of the last 11 calendar years.

- In the bull run, Index tend to outperform however during the bear market it fell significantly, suggests that inherently the focused category has high beta with respect to other market indices. High Risk-High Return proposition.

| As on 31st Jan 2025 |

|---|

| Mutual Fund Category | Standard Deviation (Ri) | Sharpe Ratio |

|---|

| 1 Yr | 3 Yrs | 5 Yrs | 7 Yrs | 10 Yrs | 1 Yr | 3 Yrs | 5 Yrs | 7 Yrs | 10 Yrs |

|---|

| Focused | 13.40 | 13.71 | 18.93 | 17.92 | 17.10 | 0.43 | 0.53 | 0.63 | 0.44 | 0.43 |

| Large-Cap | 11.73 | 12.91 | 17.94 | 16.71 | 15.68 | 0.32 | 0.49 | 0.60 | 0.43 | 0.38 |

|

Over the short, medium, and long term, the Focused mutual fund category has delivered superior risk-adjusted returns compared to the Large Cap category.

Date Source: Morningstar Direct, BALIC Research

Note: - 10 Years period is taken for return (price return) & risk (standard deviation) as on 31st Jan 2025. Average daily standard deviation annualized

Why a Focused Fund

High-Conviction, Concentrated Portfolio

Invests in a select group of high-potential stocks, enabling a sharper focus on quality businesses with strong growth prospects.

Alpha Generation

A concentrated approach may help the fund to capitalize on high-conviction opportunities, aiming to deliver superior risk-adjusted returns.

Strong Stock Selection

Focuses on fundamentally strong companies with a robust earnings potential and competitive advantages, aiming for long-term wealth creation.

Multi-Cap Advantage

Offers diversification within the 25 stocks across market caps (Large, Mid, and Small Cap stocks), combining stability with the potential for higher returns.

Adaptive Investment Strategy

Provides flexibility to adjust allocations based on market trends, ensuring portfolio construction as per the market conditions.

-Calculator.svg)

An ISO 9001:2015

An ISO 9001:2015