Term Insurance Calculator

Shield against death, terminal illness & disability

Bajaj Allianz Life eTouch II covers you against death & terminal illness. It also waives your future premiums due (if any) in case of diagnosis of Accidental Total Permanent Disability or Terminal Illness (whichever is earlier)

Flexibility to pay

You can pay premiums throughout the policy term, or for a limited number of years, or till your retirement (Age 60)

Early Exit Value

Exit early (after your need for cover is over) and get back up to 200% of your total paid premiums* plus underwriting extra premium as Early Exit Value, as per product terms and conditions

*Total Premium means total of all the premiums paid under the base product, excluding any extra premium and taxes, if collected explicitly. Please note that GST and cess, if any, will be collected over and above the premium under the policy.

Customer Speaks

Term Insurance Calculator for NRI

If you’re living outside India, you might be classified as a Non-Resident Indian (NRI). An NRI is someone of Indian origin who spends a certain number of days abroad for work, business, education, or other purposes. Despite residing overseas, you can still secure financial protection in India through NRI term insurance. This ensures your loved ones back home are financially secure in case of any unforeseen events. With term life insurance for NRI, you can choose a policy that suits your needs.

You can use a term insurance calculator to estimate how much you will pay for term life insurance. A term insurance calculator is an effective online tool designed to help you calculate the premium cost for your desired term insurance coverage based on age, income, gender, health, smoking history, number of dependents, etc.

It offers insights on how much a desired insurance coverage will cost you to enable you to choose a term insurance policy which aligns with your financial goals and budget. The term insurance calculator is free to use and calculates the premiums instantly

What is a Term Insurance Premium Calculator?

As an NRI, you have decided to secure your family’s future with a term insurance plan. The plan would ensure that if you are not around, your family would be financially taken care of. Ever wondered how to calculate the premium for this?

A term insurance premium calculator is an online tool that helps you calculate the premium of your term insurance policy. The calculator is free to use and calculates the premiums instantly. Moreover, it also allows you to buy the term insurance policy directly online, saving time and effort.

The term insurance premium calculator uses basic details to find the premium. These details include the following4

- Your name and contact details (mobile number and email ID). These details are used for generating a personalised quote and also to send you the quote on your phone or email

- Date of birth or age

- Gender

- Smoking or tobacco consumption habits

- Educational Qualification

- Occupation

- Annual income

- Sum assured

- Policy tenure

- Premium paying tenure

- Premium paying frequency

- Optional riders

- Policy variant (if available)

- Country of residence

Based on these details, the premium is calculated and shown. You can change the calculated premium by changing your coverage details like the sum assured, policy tenure, premium paying term and frequency, riders, etc.

What does a term insurance calculator do?

A term insurance calculator helps you to calculate the premium of your suitable term insurance policy with a desired sum assured. It requires certain inputs such as your name and contact details, mobile number and email ID, date of birth and age, annual income, gender, lifestyle habits such as tobacco/nicotine consumption or smoking habits, education qualification, occupation, etc., to offer term insurance policies suitable for you based on your inputs.

You can select the suitable term insurance plan and then choose a desired sum assured. Based on the term insurance policy and desired sum assured selected, the calculator provides insights into how much premium you would have to pay for the given sum assured, policy tenure, premium payment tenure, premium payment frequency and benefit pay-out option. This free and easy-to-access tool assists in comparing different options and choosing the suitable plan based on their family needs and financial goals. Thus, with the calculator, NRI term insurance policy comparison becomes simpler and more effective. You can compare the premiums of different term plans and choose a plan that matches your needs and is affordable too.

How to use a term insurance calculator?

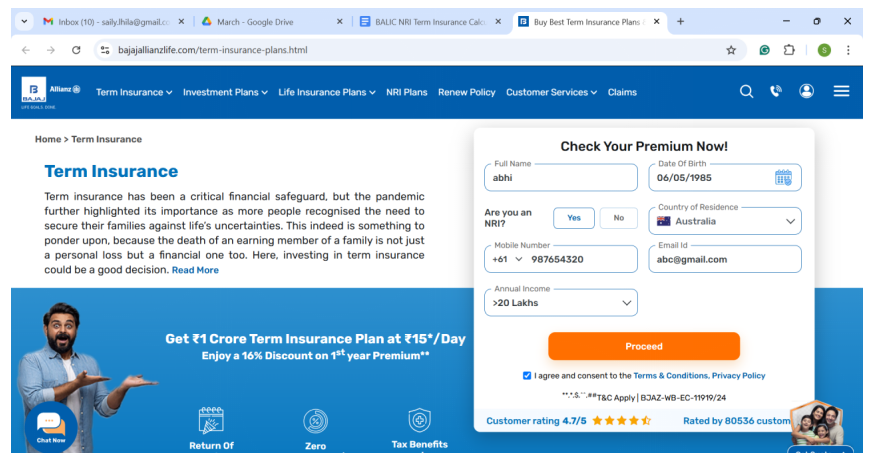

Here are the steps to use Bajaj Allianz Life Term Insurance Calculator:

1. Go to the official website of Bajaj Allianz Life and open the ‘Term Insurance’ page or simply click on https://www.bajajallianzlife.com/term-insurance-plans.html

2. In the Term Insurance Calculator, fill in the following details:

- Your Full Name

- Date of Birth

- Are you an NRI? (Select ‘Yes’)

- Country of Residence

- Your Mobile Number

- Your Email ID

- Annual Income Range

3. After filling in all the details, tick on the “I agree and consent to the Terms & Conditions, Privacy Policy” and then click on “Submit.”

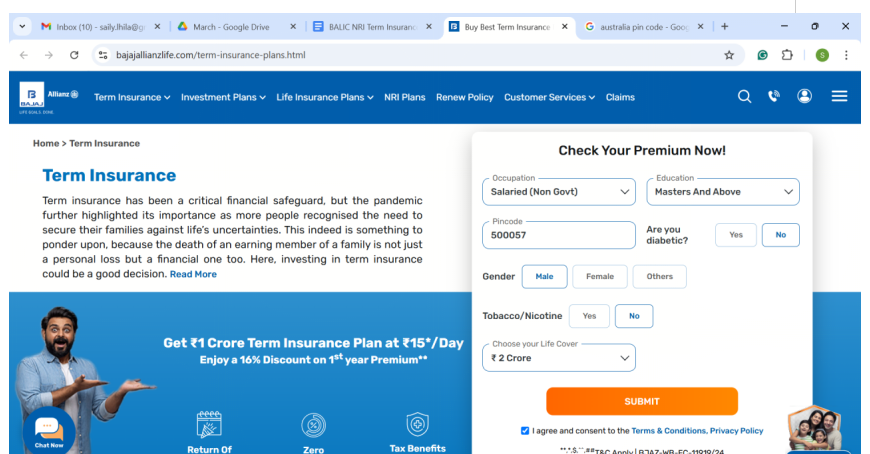

4. In the next section, fill out your -

- Occupation

- Education level

- Are you a Diabetic - Yes or No

- Gender

- Tobacco/Nicotine - Yes or No

- Choose your Life Cover

After entering these details, again select ‘I agree and consent to the Terms & Conditions, Privacy Policy” and then click on “Submit.

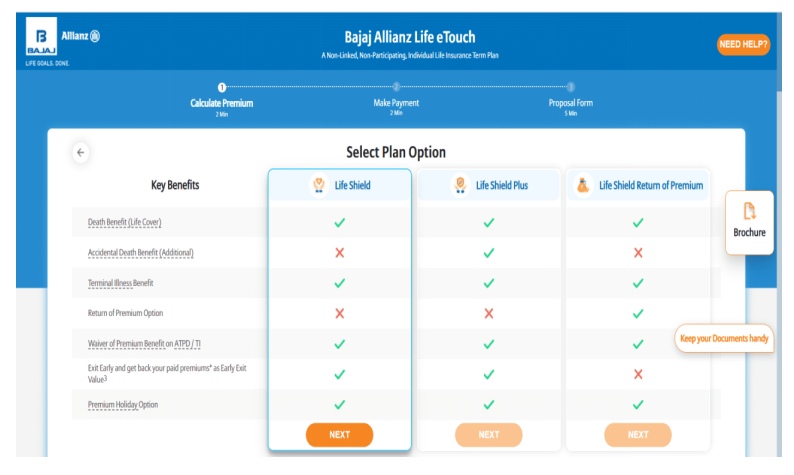

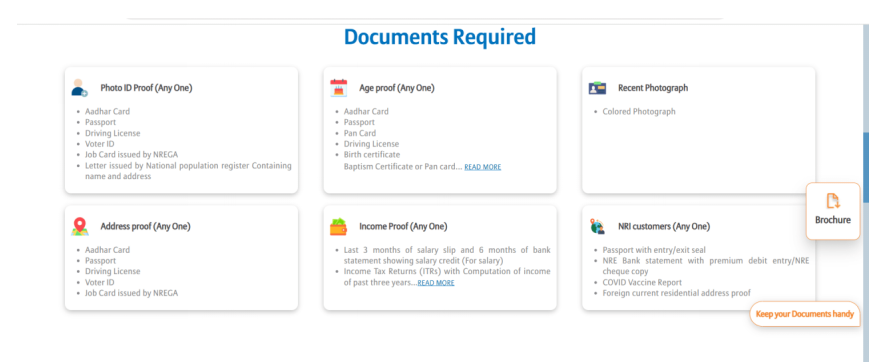

5. Once you click on submit, the term insurance calculator will show you the available term insurance plan that best suits your insurance needs based on the inputs you provided. You can also view the plan brochure. It will also show the list of documents required to buy the suggested term insurance plan so that you can keep these documents handy

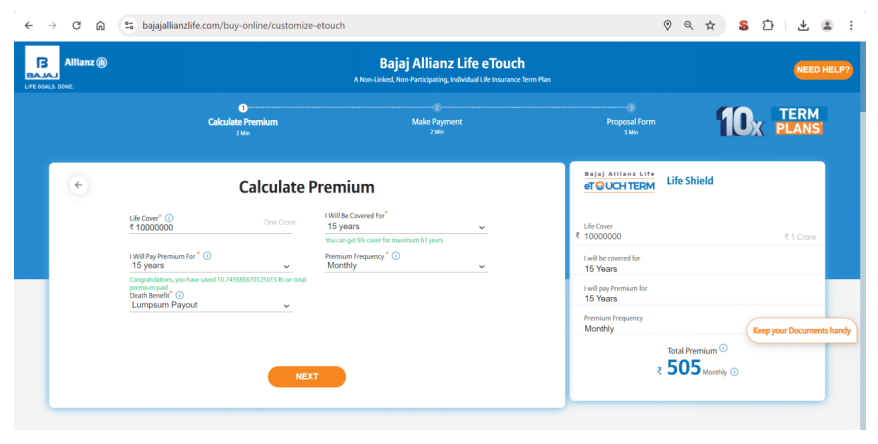

6. Once you select the desired plan option and click on “Next,” you will be redirected to a page where you will need to provide the insurance details such as:

- The amount of life cover

- The number of years for which you want the coverage (i.e., the tenure of the plan)

- The premium payment tenure

- The premium payment frequency

- The benefit pay-out option

7. Once you fill in the required details, the term insurance calculator will calculate and show the premium on the right-hand side of the window. Any changes made in the inputs will update the premiums on the right-hand side, and you can use different inputs to check the effect on the premium cost.

8. After finalising the insurance policy details and premium, click on “Next” to proceed.

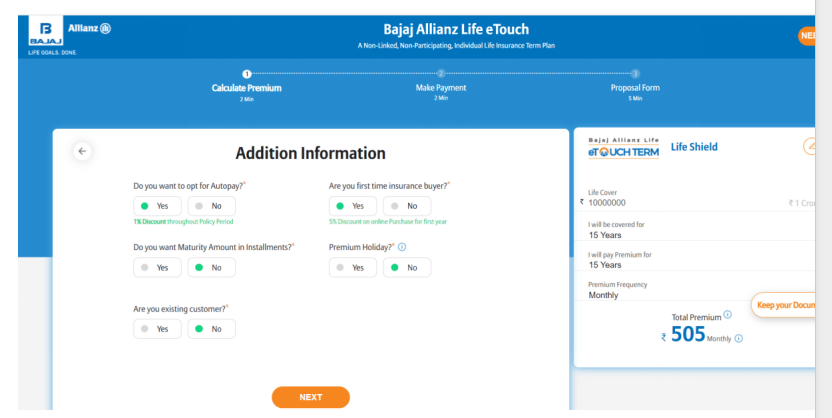

9. Then, you will be required to provide additional information such as:

- First-time insurance buyer (For first-time buyers, Bajaj Allianz Life offers specified policy discounts)

- If you want to opt to get the maturity amount in instalments

- Premium holiday option

- If you are an existing customer.

10. After filling in the additional details, click on “Next.”

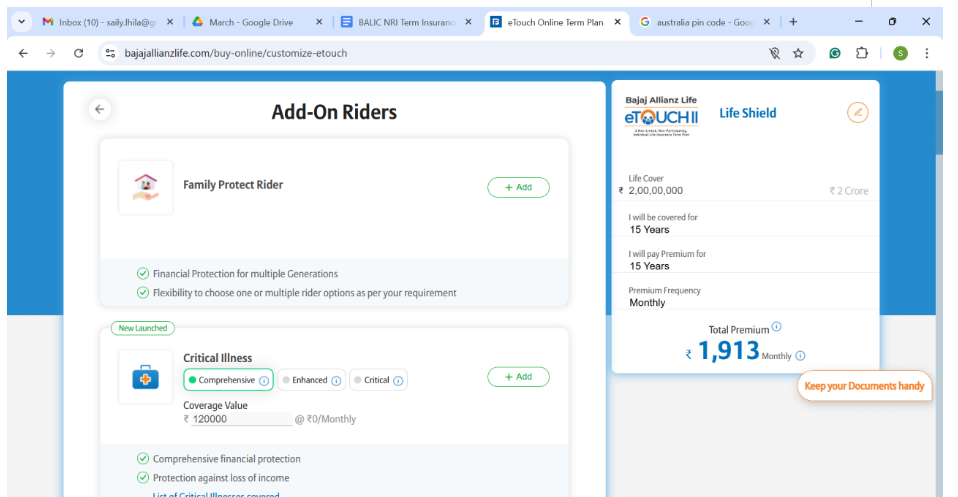

11. On the next page, you can choose to add riders to your policy. The rider benefits and premiums will be displayed and you can choose to add the rider or proceed without. If you choose a rider, the premium amount would increase marginally to factor in the rider premium. In either option, click ‘Next’ to go to the premium payment gateway.

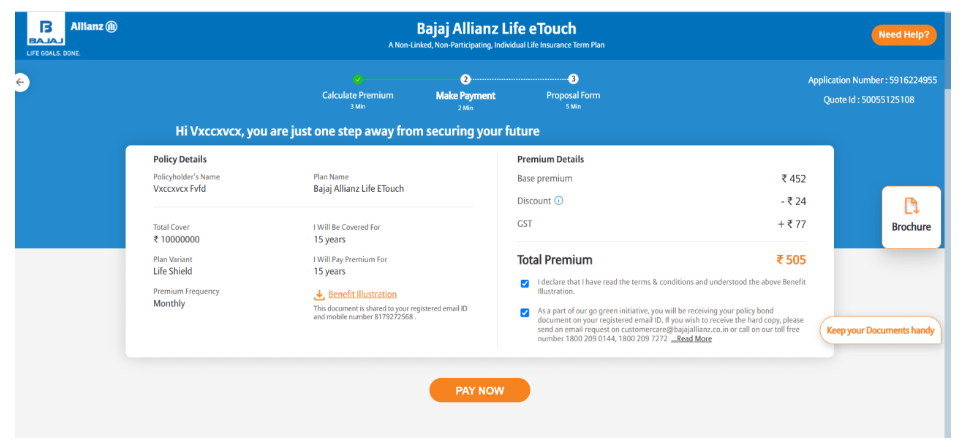

12. On the next page, the window will show all your details, including:

- Application number

- Quote ID

- The amount of premium you need to pay

13. Check the details properly and agree to the terms and conditions to proceed.

14. After checking your details and the term plan details, click on “Pay Now.”

15. You will be redirected to the page showing your payment details and application number. Tick on the disclaimer checkbox and proceed with the payment through the offered secured payment gateways.

16. Once the premium is paid, fill out the proposal form and submit it with the relevant documents for issuance of the term insurance policy.

Benefits of Term Insurance Plan Premium Calculator for NRIs

An NRI term insurance plan premium calculator is a helpful tool with various benefits. Some of these benefits are as follows4-

- The calculator shows the payable premium and gives you complete transparency about the estimated cost of the term insurance policy. It helps in understanding term insurance premiums in INR for NRIs, making it easier to plan finances in your home currency. You know approximately how much you are paying and what you are getting against the premium paid

- The calculator shows personalised quotes and helps you tailor your cover according to your needs. NRIs can adjust the coverage based on their global income and liabilities, ensuring their family in India is adequately financially protected.

- You can use the term plan premium calculator to compare the premium across different plans and find the best term plan. This makes term insurance policy comparison for NRIs simple, allowing you to choose a plan that offers the right balance of coverage and affordability.

- By showing the premium payable, the calculator helps you with budgeting and planning for premium payments in advance. You can assess if the premiums are affordable and even adjust the coverage to change the premium The calculator is completely free of cost and helps you calculate the premium for the policy before you actually buy the plan.

How to Calculate Term Life Insurance Coverage?

You can use the online term life insurance for NRIs calculator to calculate term life insurance coverage. The calculator uses your personal and financial details to assess the estimated coverage amount based on your needs. You can also find the premium payable yearly, half-early, quarterly, or monthly and choose a payment mode that suits your international banking preferences. To use the calculator, you have to enter some details, and based on those details, the recommended sum assured is calculated and shown. You can choose the recommended sum assured or choose a sum assured based on your needs. The details may vary depending on the insurer's terms and conditions.

How do you choose the right sum assured?

As a NRI, if you are the sole breadwinner of your family, you might have to consider options to provide financial security to your family in your absence.. Term insurance policy with adequate sum assured is important to build a financial safety net for your loved ones. Choosing the right sum assured is crucial as it determines the financial security of your family in case of an unfortunate event. While choosing the sum assured in the term plan, analyse your working years and consider your current income, future financial obligations, debts, number of dependents and lifestyle needs. A sum assured covering these aspects ensures that your family maintains their standard of living and meets financial obligations without worry.

Some of the ways in which you can find the right sum assured of a term insurance plan are as follows1 –

Multiple of the annual income

One of the most basic ways of calculating the sum assured is to choose 10-12 times the annual income as the coverage level. For instance, if you earn ₹10 lakhs annually, the sum assured should be ₹1 - ₹1.2 crores.

Financial needs analysis

This is a more holistic approach wherein the liabilities, assets and financial needs of the family are taken into consideration. The sum assured is calculated in such a manner that it would be sufficient to pay for your liabilities and provide a monthly income to your family in your absence so that they can meet their lifestyle expenses.

Human Life Value (HLV) method

Under the HLV method, the value of human life is quantified to find the sum assured. For instance, if you are able to provide ₹20,000 to your family every month for their financial needs, the sum assured should be sufficient to provide this amount in your absence when invested in a risk-free avenue. So, if the risk-free interest rate is considered to be 6% per annum, this would give us a corpus of ₹40 lakhs (₹2,40,000/6% X 100%), which will yield ₹2.4 lakhs every year to meet your family’s monthly expense of ₹20,000.

Why is it Important to Choose the Right Sum Assured for Term Insurance?

As a NRI, securing your family’s financial future in India is essential, especially if they depend on you for their living expenses. Choosing the right sum assured is vital as it directly impacts the level of financial security your family gets in your absence. An insufficient sum assured may make your family vulnerable to financial distress, while an excessively high amount can involve unnecessary premium costs and financial burdens. Striking the balance ensures comprehensive and cost-effective insurance coverage without straining your budget.

Who should buy a term plan?

The following NRIs may find purchasing a term plan suitable for their needs:

NRIs with Families in India:

If you are an NRI with dependents in India, NRI term insurance ensures their financial security in in case of your untimely demise during the policy tenure . It can help cover daily expenses, education costs, and other financial needs, ensuring that your family can maintain their standard of living even when you are not around.

Young working NRI professionals:

Your premium for a term plan may increase as you age. Hence, if you are a young earning professional, you may want to buy a term plan as soon as you can. The affordable premiums might help you avail a high life cover right from the beginning.

NRIs with Liabilities in India:

If you have outstanding loans such as home loans, business loans, or any other liabilities in India, a term plan for NRI can ensure that your family is not burdened with repayments in your absence if the sum assured is higher than your outstanding loans. The support provided by the term plan may help them pay off these liabilities in your absence.

When should I buy a term plan?

The sooner you buy a term plan, the better it may be for you. The premium of a term plan depends upon various factors, including age and could increase as you age. Since people can experience more health issues when they are older, leading to an increased mortality risk, they may have to pay higher premiums, too. You can use a term insurance calculator to check how the premium changes with a change in age. Hence, it may be preferable to buy the term plan when younger.

Factors to consider before using a term insurance premium calculator

The different factors to consider before using a term insurance premium calculator are detailed below:

Age and Life Expectancy:

Age is one of the most significant factors that affect life insurance premiums as it determines your mortality risk. With the increase in age, the body of an individual grows weak, and diseases set in. Further, their life expectancy also decreases. Hence, term insurance premiums are usually higher in older ages than in younger ages. When using the calculator, your life expectancy will help you determine the policy tenure for maximum coverage. This will also help you find the relevant premium of the policy.

Occupation:

Some occupations, such as mining, construction, aviation, defence, politics, etc., are dangerous and involve high mortality risk, attracting higher premiums. Moreover, if you are living in a risk-prone country, your premiums might be higher.1

Smoking habit:

Term insurance premiums are higher for individuals who smoke as smoking involves health hazards. Alternatively, non-smokers have lower premium rates since they are considered healthy.

Lifestyle habits such as drinking habits or tobacco consumption:

If an individual has bad lifestyle habits like substance abuse like tobacco consumption or drinking habits, the premiums would be higher.

Health condition:

Individuals having diabetic conditions or adverse health conditions such as hypertension, etc., have higher premium charges.

Sum Assured and Tenure of the Plan:

The amount of coverage in the term plan directly affects the premium. The higher the sum assured, the higher would be the premium and vice versa. Similarly, tenure affects the premiums. The longer the coverage, the lower will be the annual premium and vice versa.

Benefits and features:

Other features, such as premium payment terms and frequency, benefit pay-out options, etc. determine the premium cost. Yearly premium payment frequency has lower premiums than monthly or any other premium payment modes.

Add-on benefits and optional riders:

Add-on benefits include inbuilt riders, additional coverage options, return of premium options, optional riders, whole-life coverage options, etc. A higher premium is charged for these add-on benefits. Moreover, if you buy riders with your term insurance policy for enhanced coverage, your premiums will shoot up, and you will have to pay an extra premium for each rider chosen.

Impact of smoking & occupation on premium calculation:

Smoking and occupation significantly impact premium calculations. Insurance providers consider smoking a significant risk factor due to associated health issues. Smokers typically pay higher premiums compared to non-smokers due to the increased health risks associated with smoking. Similarly, occupations involving high risk, such as those in the construction or mining industry, may attract higher premium costs due to their increased chances of accidents. Providing complete and accurate information about occupation and smoking habits ensures a realistic premium estimate.

What happens if you don't use a term plan calculator?

Not using a term plan calculator for NRI term insurance may lead to incorrect estimates of premiums, resulting in inadequate coverage or financial strain. You might end up choosing a term plan that doesn't align with your financial objectives or overpaying the premiums for coverage. A calculator offers a clear picture of your premium obligations, enabling you to make an informed financial decision and ensure your family's financial security at all times.

Claim settlement process at Bajaj Allianz Life Insurance

Bajaj Allianz is known for its prompt and efficient claim settlement, ensuring hassle-free and quick disbursement of payouts to the beneficiaries. Even if you are an NRI and living abroad, the claim process of Bajaj Allianz Life Insurance will help in easy claim settlements.

The claim settlement process at Bajaj Allianz Life Insurance is simple and involves just three steps3. Have a look -

Step | Description |

Step 1 – Claim Reporting |

|

Step 2 - Claim Processing |

|

Step 3 – Claim Settlement |

|

Conclusion:

A term insurance calculator for NRIs is an invaluable tool for estimating premiums and selecting the right term insurance policy. The calculator aids in decision-making, ensures that you buy a plan with adequate coverage which provides financial security to your family wherever you live. You can use a term insurance calculator to compare different term plans, adjust coverage parameters, and find the suitable term policy which fits your insurance needs and budget constraints. You can buy the policy online, even from a foreign country, and get covered against life’s uncertainties.

Frequently Asked Questions

1. Can NRIs buy term insurance in India while living abroad?

Yes, online term insurance for NRIs allows them to purchase term life insurance without being physically present in India. Some insurers may require medical tests depending on the policy.1

2. Will my NRI term insurance cover me anywhere I go?

Yes, most NRI term insurance policies offer global coverage, meaning you will be covered regardless of where you live2. However, you must inform them if you relocate. The insurer must have your latest address and contact details. It’s best to check the policy terms to ensure uninterrupted coverage.

3. What payment options for NRI term insurance policies are available?

NRIs can pay their term insurance premiums through various methods, including NRE/NRO bank accounts, international credit or debit cards, swift transfers, or online payment gateways1. It's advisable to check with your insurer for specific payment options and currency preferences.

4. Do NRIs get tax benefits on term insurance?

Yes, tax benefits of term insurance for NRIs are available under Section 80C (under old tax regime) of the Income Tax Act, allowing deductions on premiums paid for policies issued in India.3

5. How does the term plan work for NRIs?

A term plan for NRIs functions like a regular term insurance policy. The NRI chooses coverage and pays premiums. It ensures that the family has a safety net for future expenses like loans, education, or daily needs in case of an unfortunate event. Depending on the insurer, NRIs can buy the plan online or offline, and the policy offers global coverage and tax benefits of term insurance for NRIs.

Life Insurance Guide

Videos

Articles

Calculators

Podcasts

Death benefit is the amount that the life insurance company provides to the beneficiary in case of unforeseen demise of the life assured during the policy tenure

Cracking the Code: Understanding Annualized Premium in Insurance

A type of life insurance policy that covers two lives under a single plan, typically taken by spouses.

Understanding #lifeinsurance terms may be challenging. As part of Bajaj Allianz Life’s #LifeInsuranceMadeEasy series we are simplifying industry terminology

Watch this video from the #LifeInsuranceMadeEasy series, a customer education initiative by Bajaj Allianz Life to know how Autopay simplifies the premium

#Lifeinsurance terms got you mixed-up? As part of #LifeInsuranceMadeEasy series, Bajaj Allianz Life’s is helping to simplify industry terminologies

One of the most effective methods of providing for your family in your absence is term insurance. .....

Many people may opt for a term insurance policy to secure their family’s financial future in their absence. The financial support received from a term insurance...

Ask this question, and the primary reason that would come to mind would be comprehensive coverage. Term plans cover death of the life insured during the....

Even at the best of times, life can be unpredictable and emergencies can strike without a moment’s notice. Therefore, in order to never find yourself in.....

With the Underinsurance Calculator, check if your Life Cover is atleast 10x of your Annual Income.

Answer a few easy questions to calculate your Fixed Deposit Returns.

Calculate your NPS returns effortlessly with our simple to use NPS Calculator.

Plan your investments effortlessly and achieve your financial goals with our easy-to-use SIP Calculator.

Answer a few simple questions to know how prepared you are for your retirement.

Answer a few simple questions to know the corpus required to fulfil your Life Goal.

A simple to use and comprehensive tool to plan for your child's education.

An easy to use Term Insurance calculator to determine the right life cover amount as per your needs.

Use this calculator to know how savings from regular expenses can help you achieve your Life Goals.

Get to know your Financial Fitness Score by answering few simple questions.

Use our immunity calculator to find out your immunity score in just a few clicks!

Know the amount to invest today to have the corpus to accomplish your Life Goals tomorrow.

Get an estimate of how much your investment will grow over a period of time.

Know your income tax based on the taxable income and explore Life Insurance plans to save more tax.

A simple to use calculator that helps you plan for fulfilling your Child's Life Goals.

Calculate the amount you need to invest today to accomplish your retirement life goals.

Answer a few simple questions to know estimated corpus you will have to fulfil your Life Goals.

Body Mass Index (BMI) is a measure to understand whether your body weight is healthy as per your height.

ft. Mr. Sameer Joshi, Chief Agency Officer, discussing how to manage finances for financial freedom.

Mr. Sampath Reddy, Chief Investment Officer, shares his views on the Union Budget 2023.

Mr. Dheeraj Sehgal, CDO – IB & Mr. Jatin Popat, WillJini discuss Will Writing & Succession Planning.

ft. Mr. Ajay Rajvanshi, Sr. EVP, as he shares his views on building wealth with SISO.

Mr. Rajesh Krishnan, COO, discusses immense investment potential of India for NRIs.

Tax benefits as per prevailing Income tax laws shall apply. Please check with your tax consultant for eligibility

The output generated through calculator are on the basis of the data filled in by you and is being provided to you solely for your reference purpose and not to be construed as investment advice. Please seek independent advice from your insurance consultant before making any investment decisions. While proper caution has been taken in designing this calculator, Bajaj Allianz Life Insurance Co. Ltd. assumes no liability for the accuracy of the information and data provided in this tool.

BJAZ-WP-ECNF-14723/25

-Calculator.svg)