Term Insurance Calculator

What is Term Insurance Premium Calculator?

A term insurance premium calculator is an online tool that helps you calculate the premium of your term insurance policy. The calculator is free to use and calculates the premiums instantly. Moreover, it also allows you to buy the term insurance policy directly online, saving time and effort.

Key Benefits

Shield against death, terminal illness & disability

Bajaj Allianz Life eTouch II covers you against death & terminal illness. It also waives your future premiums due (if any) in case of diagnosis of Accidental Total Permanent Disability or Terminal Illness (whichever is earlier)

Flexibility to pay

You can pay premiums throughout the policy term, or for a limited number of years, or till your retirement (Age 60)

Early Exit Value

Exit early (after your need for cover is over) and get back up to 200% of your total paid premiums* plus underwriting extra premium as Early Exit Value, as per product terms and conditions

*Total Premium means total of all the premiums paid under the base product, excluding any extra premium and taxes, if collected explicitly. Please note that GST and cess, if any, will be collected over and above the premium under the policy.

Customer Speaks

The term insurance premium calculator uses basic details to find the premium. These details include the following:

- Your name and contact details (mobile number and email ID)

- Date of birth or age

- Gender

- Smoking or tobacco consumption habits

- Educational Qualification

- Occupation

- Annual income

- PIN code

- Sum assured

- Policy tenure

- Premium paying tenure

- Premium paying frequency

- Optional riders

- Policy variant (if available)

Based on these details, the premium is calculated and shown. You can change the calculated premium by changing your coverage details like the sum assured, policy tenure, premium paying term and frequency, riders, etc.

What does a term insurance calculator do?

A term insurance calculator helps you to calculate the premium of your suitable term insurance policy with a desired sum assured. It requires certain inputs such as your name and contact details, date of birth, annual income, gender, lifestyle habits, education qualification, occupation, etc., to offer term insurance policies suitable for you based on your inputs.

You can select the suitable term insurance plan and then choose a desired sum assured. Based on the term insurance policy and desired sum assured selected, the calculator provides insights into how much premium you would have to pay for the given sum assured, policy tenure, premium payment tenure, premium payment frequency, and benefit pay-out option. This free and easy-to-access tool assists policyholders in making informed decisions about selecting the right policy based on their family needs and meeting their financial goals.

How to use a term insurance calculator?

Here are the steps to use Bajaj Allianz Life Term Insurance Calculator:

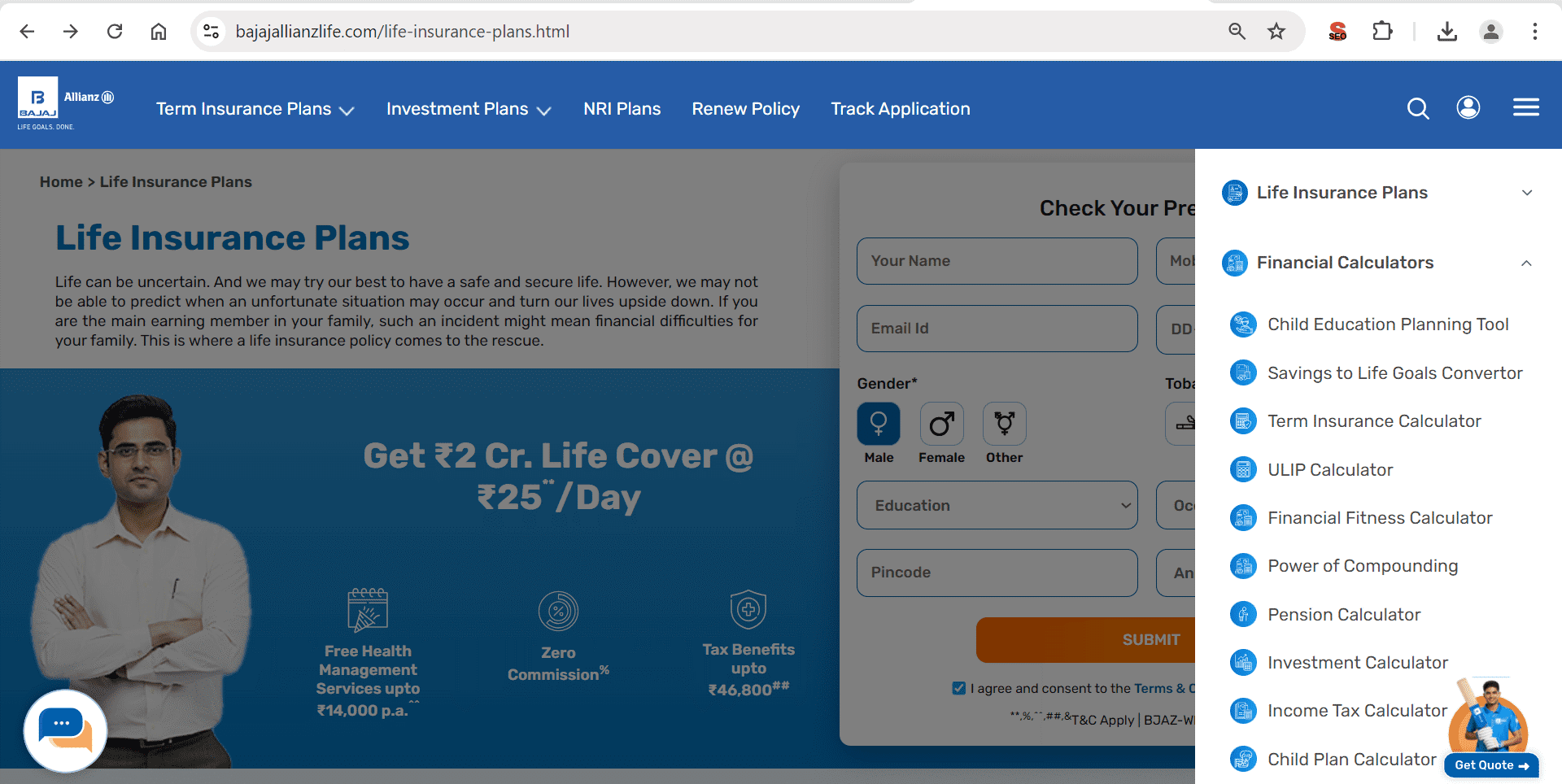

- Go to the official website of Bajaj Allianz Life and click on “Financial Calculator” to select “Term Insurance Calculator” or simply click on the link below: Bajaj Allianz Life Term Insurance Calculator

- Bajaj Allianz Life Term Insurance Calculator Page will open.

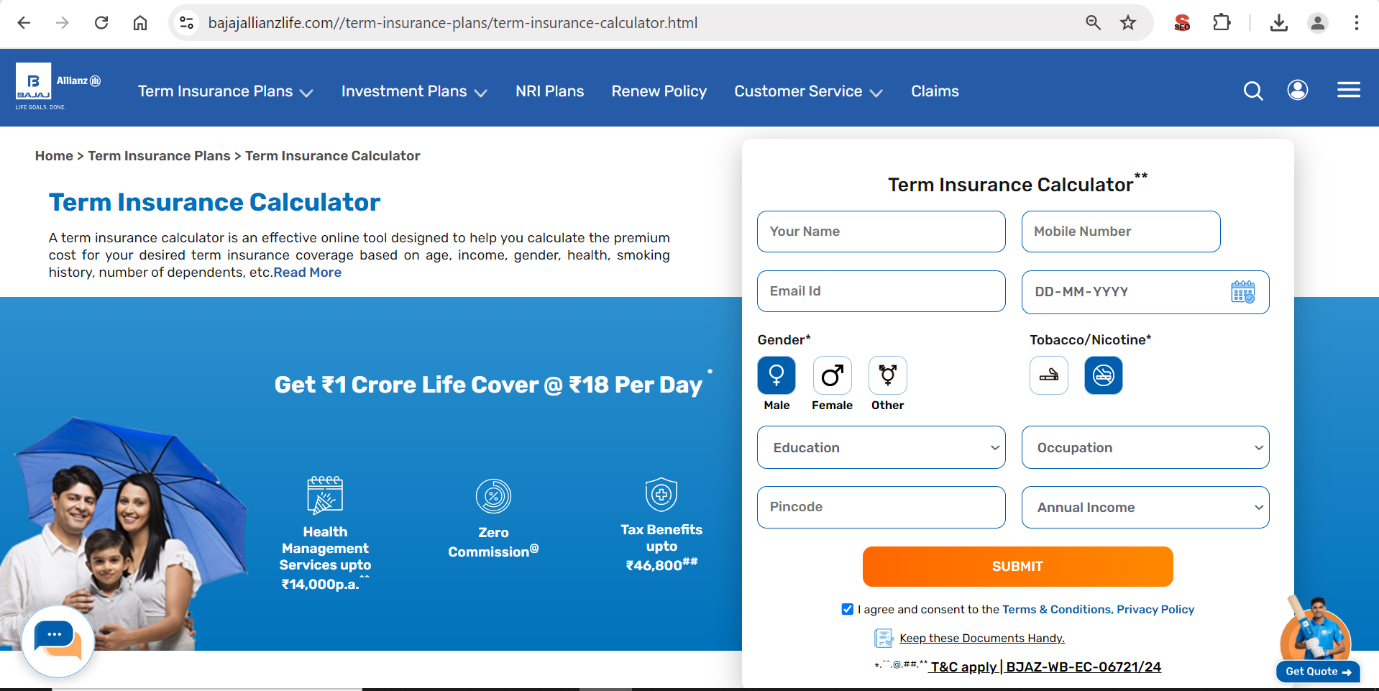

- In the Term Insurance Calculator, fill in the following details:

- Your Full Name

- Your Mobile Number

- Your Email ID

- Date of Birth

- Gender

- If you consume Tobacco/Nicotine

- Your Education Qualification

- Your Occupation

- PIN Code

- Annual Income Range

- After filling in all the details, tick on the “I agree and consent to the Terms & Conditions, Privacy Policy” and then click on “Submit.”

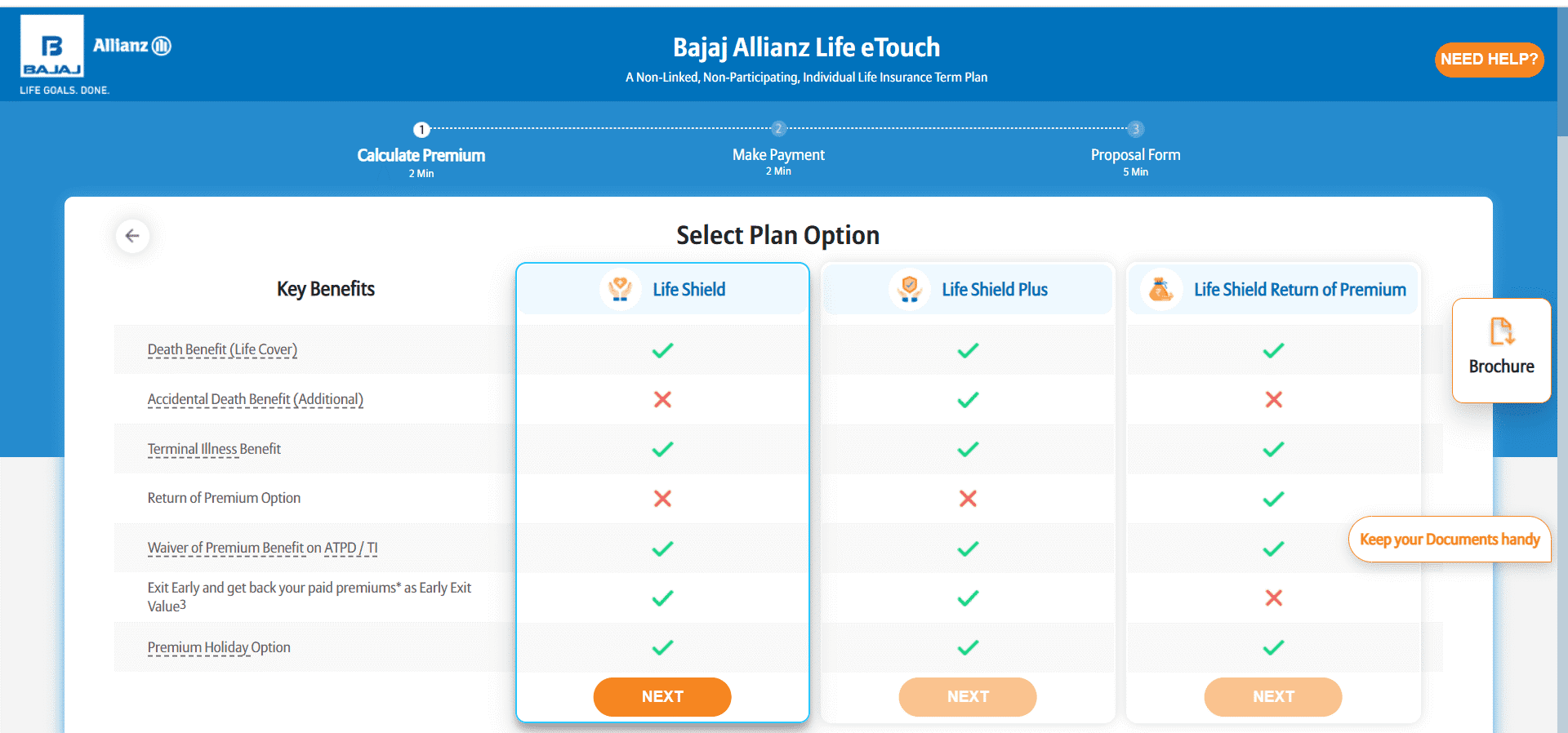

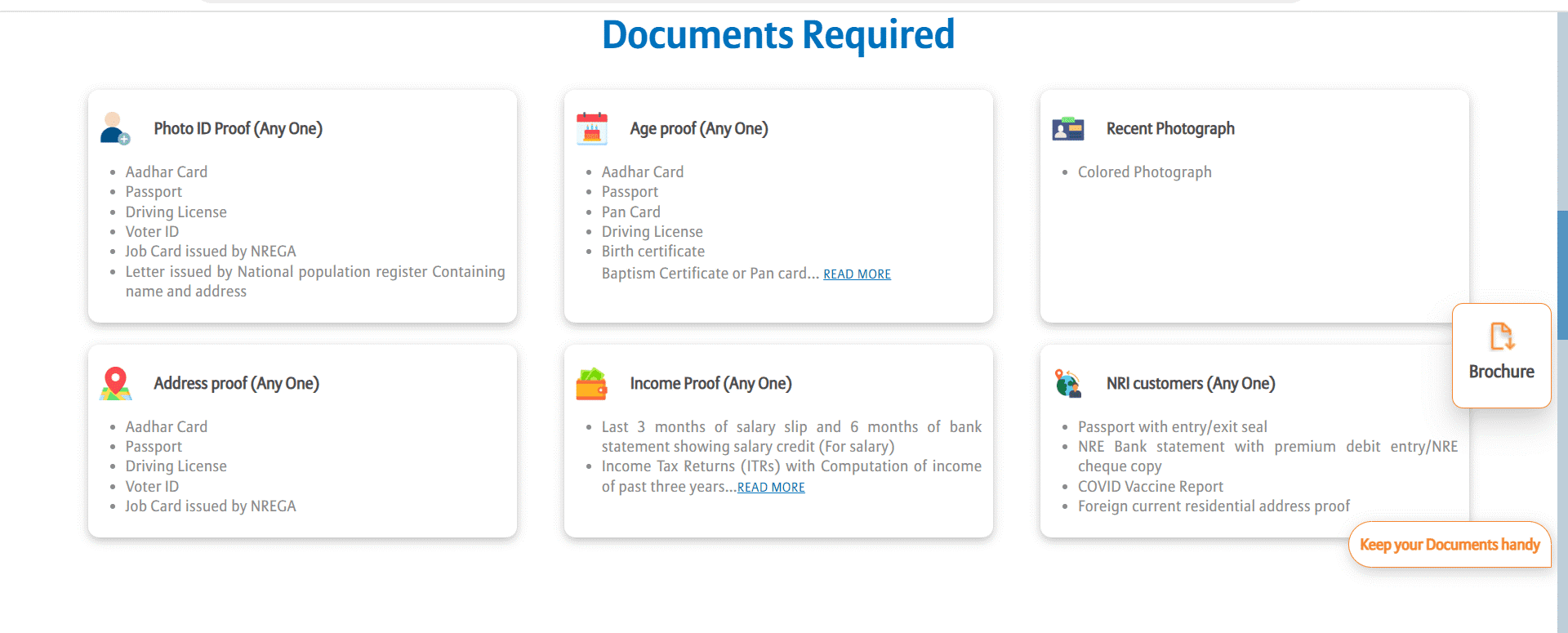

- Once you click on submit, the term insurance calculator will show you the available term insurance plan that best suits your insurance needs based on the inputs you provided. You can also view the plan brochure. It will also show the list of documents required to buy the suggested term insurance plan so that you can keep these documents handy.

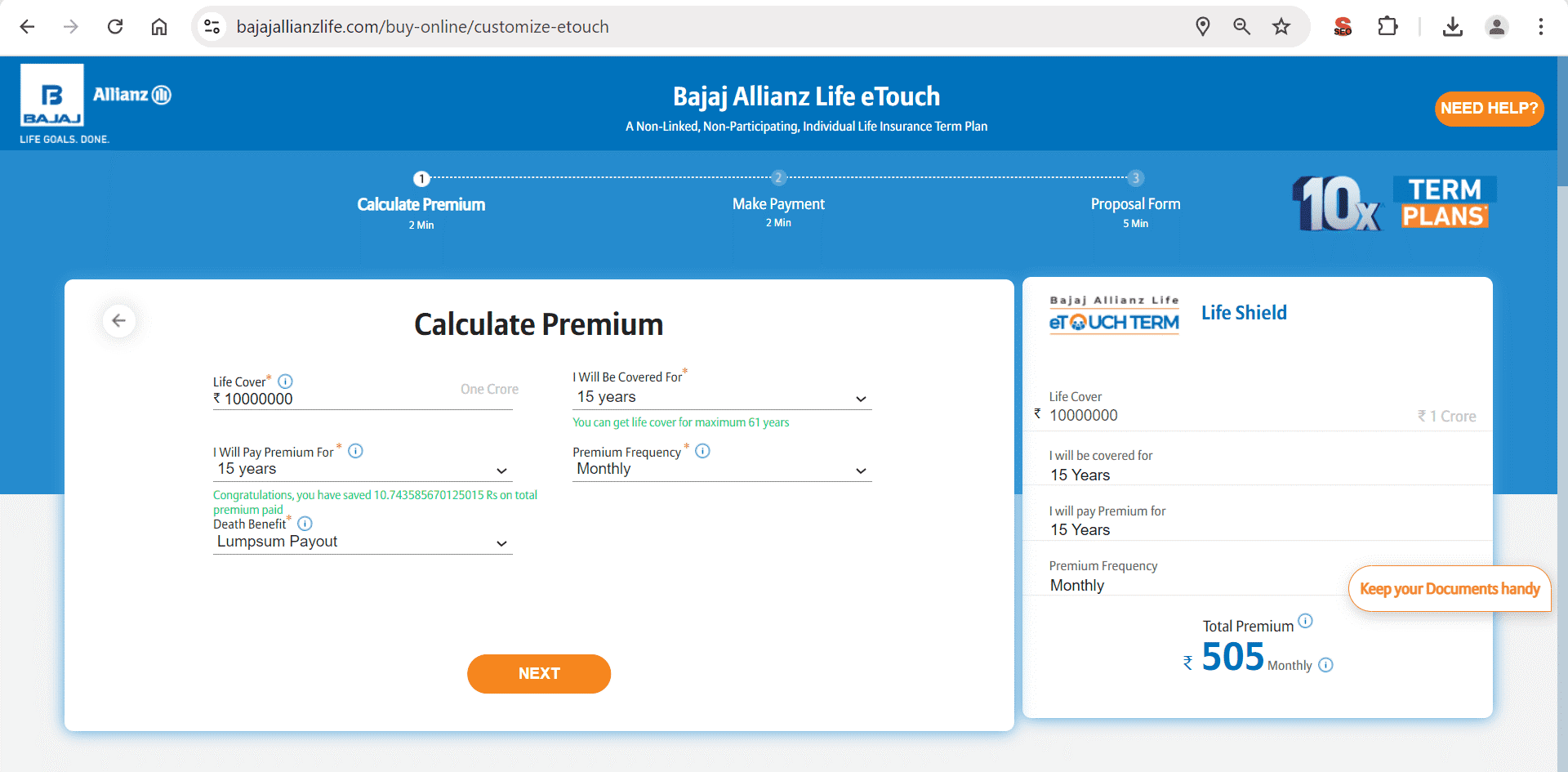

- Once you select the desired plan option and click on “Next,” you will be redirected to a page where you will need to provide the insurance details such as:

- The amount of life cover

- The number of years for which you want the coverage (i.e., the tenure of the plan)

- The premium payment tenure

- The premium payment frequency

- The benefit pay-out option

- Once you fill in the required details, the term insurance calculator will calculate and show the premium on the right-hand side of the window. Any changes made in the inputs will update the premiums on the right-hand side, and you can use different inputs to check the effect on the premium cost.

- After finalizing the insurance policy details and premium, click on “Next” to proceed.

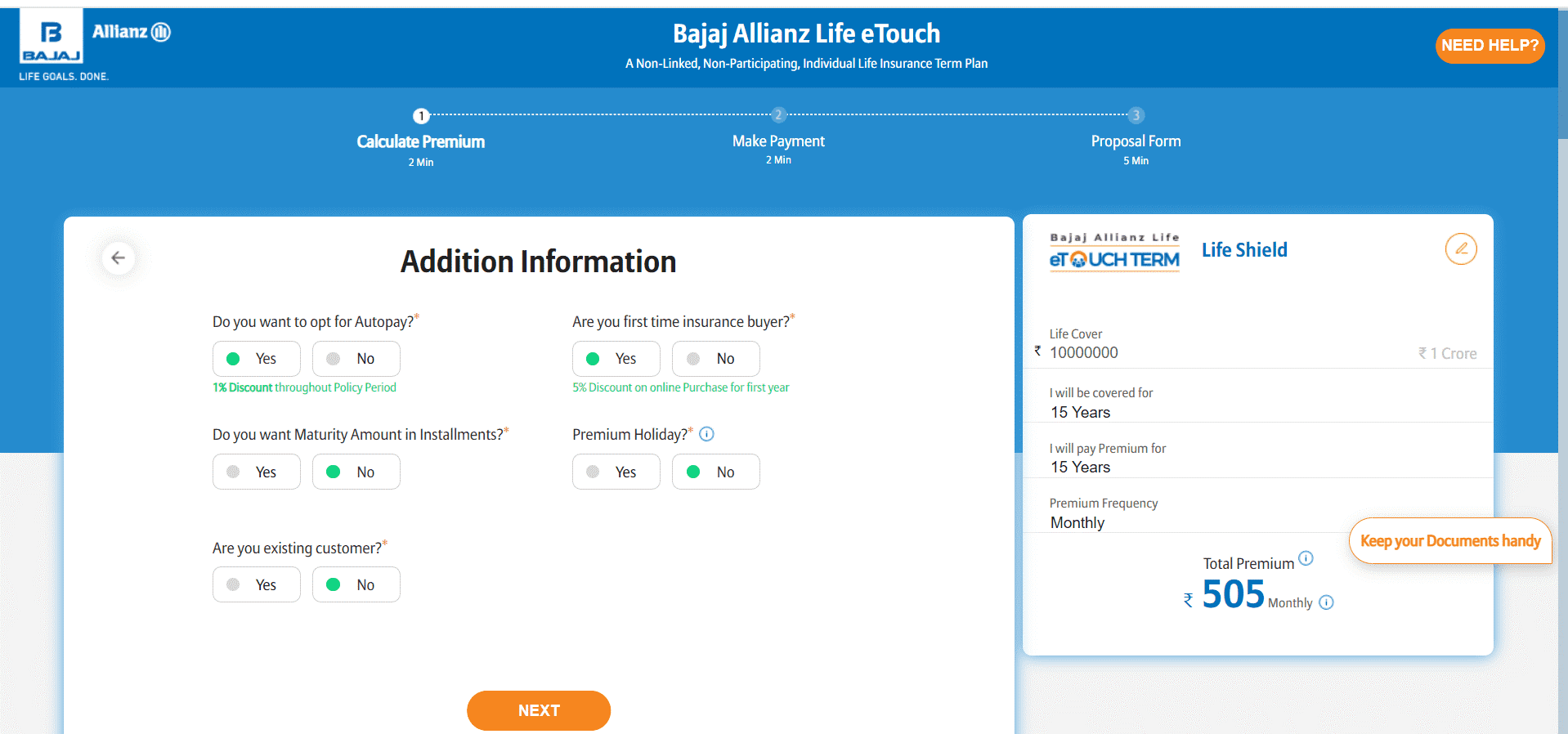

- Then, you will be required to provide additional information such as:

- Opting to autopay

- First-time insurance buyer

- If you want to opt to get maturity amount in instalments

- Premium holiday option

- If you are an existing customer

- After filling in the additional details, click on “Next.” Then, you will be redirected towards making the payment.

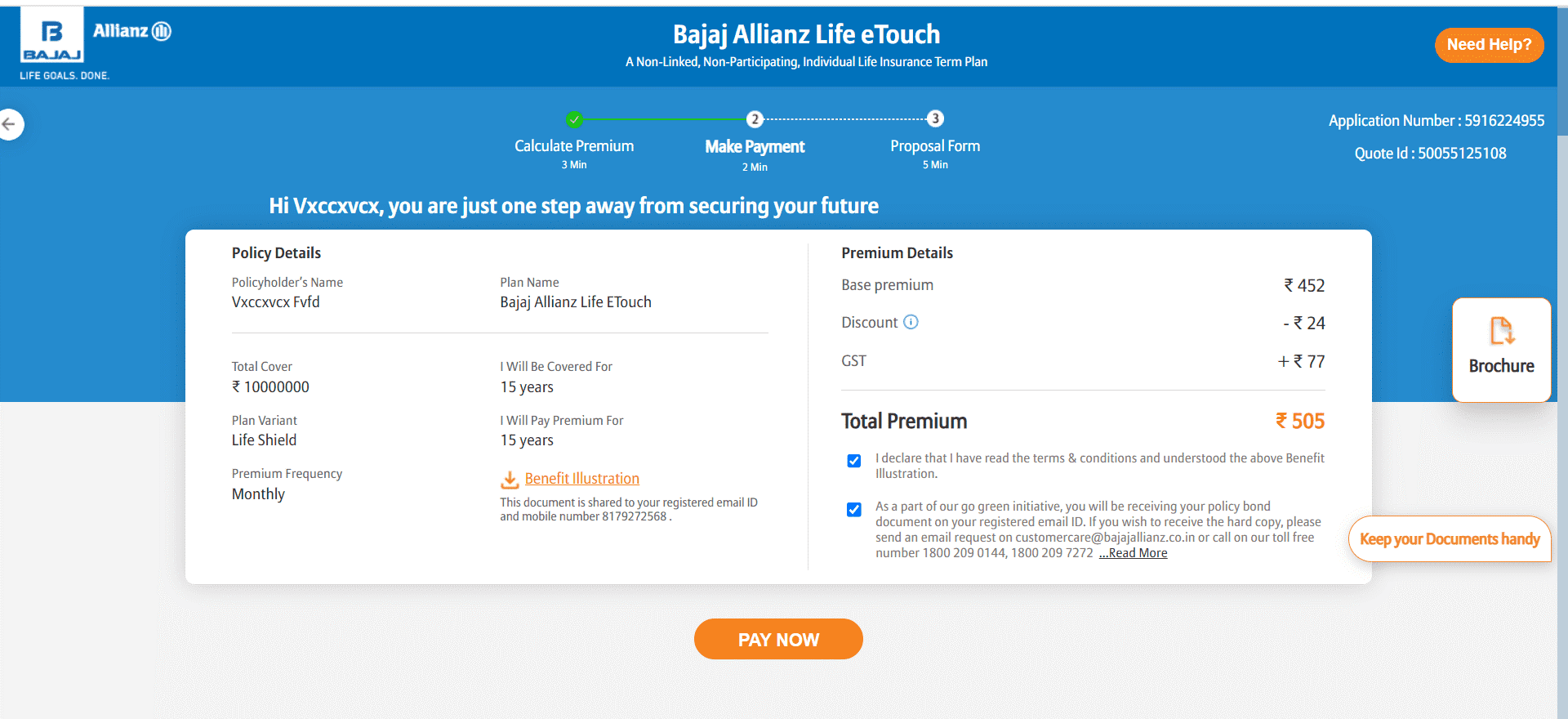

- On the next page, the window will show all your details, including:

- Application number

- Quote ID

- The amount of premium you need to pay

Check the details properly and agree to the terms and conditions to proceed.

- After checking your details and the term plan details, click on “Pay Now.”

- You will be redirected to the page showing your payment details and application number. Tick on the disclaimer checkbox and proceed with the payment through the offered secured payment gateways.

- Once the premium is paid, fill out the proposal form and submit it with the relevant documents for issuance of the term insurance policy.

Benefits of Term Insurance Calculator

A term insurance plan premium calculator is a helpful tool with various benefits. Some of these benefits are as follows:

- The calculator shows the payable premium and gives you complete transparency about the estimated cost of the term insurance policy. You know how much approximately you are paying and what you are getting against the premium paid.

- The calculator shows personalised quotes and helps you tailor your cover according to your needs.

- You can use the term plan premium calculator to compare the premium across different plans and find the best term plan.

- By showing the premium payable, the calculator helps you with budgeting and planning for premium payments in advance. You can assess if the premiums are affordable and even adjust the coverage to change the premium.

- The calculator is completely free of cost and helps you calculate the premium for the policy before you actually buy the plan.

How to Calculate Term Life Insurance Coverage?

You can use the online term life insurance calculator to calculate term life insurance coverage. The calculator uses your personal and financial details to assess the estimated coverage amount based on your needs. To use the calculator, you have to enter some details and based on those details the recommended sum assured is calculated and shown. You can choose the recommended sum assured or choose a sum assured based on your needs. The details may vary depending upon the insurers terms and conditions.

How do you choose the right sum assured?

Some of the ways in which you can find the right sum assured of a term insurance plan are as follows1 –

Multiple of the annual income

One of the most basic ways of calculating the sum assured is to choose 10-12 times the annual income as the coverage level. For instance, if you earn ₹10 lakhs annually, the sum assured should be ₹1 - ₹1.2 crores.

Financial needs analysis

This is a more holistic approach wherein the liabilities, assets and financial needs of the family are taken into consideration. The sum assured is calculated in such a manner that it would be sufficient to pay for your liabilities and provide a monthly income to your family in your absence so that they can meet their lifestyle expenses.

Human Life Value (HLV) method

Under the HLV method, the value of human life is quantified to find the sum assured. For instance, if you are able to provide ₹20,000 to your family every month for their financial needs, the sum assured should be sufficient to provide this amount in your absence when invested in a risk-free avenue. So, if the risk-free interest rate is considered to be 6% per annum, this would give us a corpus of ₹40 lakhs (₹2,40,000/6% X 100%), which will yield ₹2.4 lakhs every year to meet your family’s monthly expense of ₹20,000.

Why is it Important to Choose the Right Sum Assured for Term Insurance?

Choosing the right sum assured is vital as it directly impacts the level of financial security your family gets in your absence. An insufficient sum assured may make your family vulnerable to financial distress, while an excessively high amount can involve unnecessary premium costs and financial burdens. Striking the balance ensures comprehensive and cost-effective insurance coverage without straining your budget.

Who should buy a term plan?

The following people may find purchasing a term plan suitable for their needs:

1. Parents

Buying a term plan may be essential if you want to secure the financial future of your children. In case of your absence, a term plan may ensure your children continue to live their lives with financial freedom.

2. Young working professionals

Your premium for a term plan may increase as you age. Hence, if you are a young earning professional, you may want to buy a term plan as soon as you can. The affordable premiums might help you avail a high life cover right from the beginning. Thus, when you have a family in the future, they will have financial security.

3. Individuals with debts

If you have any debt, you may want to ensure it does not affect your family’s financial future, by considering buying a term plan. The support provided by the term plan may help them pay off these liabilities in your absence.

When should I buy a term plan?

The sooner you buy a term plan, the better it may be for you. The premium of a term plan depends upon various factors including age and could increase as you age. Since people can experience more health issues when they are older, leading to an increased mortality risk, they may have to pay higher premiums, too. You can use a term insurance calculator, to check how the premium changes with change in age. Hence, it may be preferable to buy the term plan when younger.

| %Mr. Ajay Male, 24 years old Non Smoker Premium ₹529 monthly for 1st year ₹565 monthly from 2nd year onwards Sum Assured ₹1 Crore | *Mr. Vijay Male, 40 years old Non Smoker Premium ₹1,648 monthly for 1st year ₹1,760 monthly from 2nd year onwards Sum Assured ₹1 Crore |

Factors to consider before using a term insurance premium calculator

Age and Life Expectancy

Age is one of the most significant factors that affect life insurance premiums as it determines your mortality risk. With the increase in age, the body of an individual grows weak, and diseases set in. Further, their life expectancy also decreases. Hence, term insurance premiums are usually higher in older ages than in younger ages. When using the calculator, your life expectancy will help you determine the policy tenure for maximum coverage. This will also help you find the relevant premium of the policy.

Occupation

Some occupations, such as mining, construction, aviation, defence, politics, etc., are dangerous and involve high mortality risk, attracting higher premiums.

Smoking habit

Term insurance premiums are higher for individuals who smoke as smoking involves health hazards. Alternatively, non-smokers have lower premium rates since they are considered healthy.

Lifestyle habits such as drinking habits or tobacco consumption

If an individual has bad lifestyle habits like substance abuse like tobacco consumption or drinking habits, the premiums would be higher.

Health condition

Individuals having diabetic conditions or adverse health conditions such as hypertension, etc., have higher premium charges.

Sum Assured and Tenure of the Plan

The amount of coverage in the term plan directly affects the premium. The higher the sum assured, the higher would be the premium and vice versa. Similarly, tenure affects the premiums. The longer the coverage, the lower will be the annual premium and vice versa.

Benefits and features

Other features such as premium payment terms and frequency, benefit pay-out options, etc. determine the premium cost. Yearly premium payment frequency has lower premiums than monthly or any other premium payment modes.

Add-on benefits and optional riders

Add-on benefits include inbuilt riders, additional coverage options, return of premium options, optional riders, whole-life coverage options, etc. A higher premium is charged for these add-on benefits. Moreover, if you buy riders with your term insurance policy for enhanced coverage, your premiums will shoot up, and you will have to pay an extra premium for each rider chosen

Impact of smoking & occupation on premium calculation:

Smoking and occupation significantly impact premium calculations. Insurance providers consider smoking a significant risk factor due to associated health issues. Smokers typically pay higher premiums compared to non-smokers due to the increased health risks associated with smoking. Similarly, occupations involving high risk, such as those in the construction or mining industry, may attract higher premium costs due to their increased chances of accidents. Providing complete and accurate information about occupation and smoking habits ensures a realistic premium estimate.

What happens if you don't use a term plan calculator?

Not using a term plan calculator may lead to incorrect estimates of premiums, resulting in inadequate coverage or financial strain. You might end up choosing a term plan that doesn't align with your financial objectives or overpaying the premiums for coverage. A calculator offers a clear picture of your premium obligations, enabling you to make an informed financial decision and ensure your family's financial security at all times.

Claim settlement process at Bajaj Allianz Life Insurance

Bajaj Allianz is known for its prompt and efficient claim settlement, ensuring hassle-free and quick disbursement of payouts to the beneficiaries. The claim settlement process at Bajaj Allianz Life Insurance is simple and involves just three steps3. Have a look -

| Step | Description |

|---|---|

| Step 1 – Claim Reporting |

|

| Step 2 - Claim Processing |

|

| Step 3 – Claim Settlement |

|

Conclusion:

A term insurance calculator is an invaluable tool for estimating premiums and selecting the right term insurance policy. The calculator aids in decision-making, ensures adequate coverage, and provides financial security to your family. You can use a term insurance calculator to compare different term plans, adjust coverage parameters, and find the suitable term policy which fits your insurance needs and budget constraints.

Frequently Asked Questions

1. What is the formula for calculating term insurance?

There is no specified formula for calculating term insurance. You can use the term insurance calculator to find the premium payable for the policy that you choose.

2. What is 1 crore term insurance?

A ₹1 crore term insurance plan is one which has a sum assured of ₹1 crore.

3. How do you decide the term insurance amount?

You can decide the term insurance amount based on your income, expenses, assets, liabilities, financial goals, etc. There are term insurance calculators that help in calculating the right sum assured.

4. Is it safe to use a term plan calculator?

The term plan calculator is an online tool which calculates the premium payable for the policy that you choose. The calculator is a safe tool which you can use to find the premium and even buy a suitable term plan.

5. Is 50 lakhs term insurance enough?

The adequacy of your term insurance coverage depends on your income, expenses, assets, liabilities, financial goals and requirements. You can use the term insurance calculator to find the right sum assured.

6. What is the premium of ₹50 lakhs term plan?

The premium depends on your age, medical history, policy term, premium payment term and frequency, riders selected, and other factors. You can use the term insurance calculator to find the premium payable for a ₹50 lakh term plan.

7. What is the premium of 2 crore term plan insurance?

The premium for a ₹2 crore term plan depends on your age, medical history, policy details, riders selected, and other factors. To find the exact premium, you can use the online term insurance calculator.

8. What is the premium of ₹1 crore term insurance plan?

The premium of ₹1 crore term insurance plan can be found using the online term insurance calculator. The premium is not same for every individual. It varies based on age, policy details, riders selected, and other factors. The calculator, thus, calculates the exact premium based on these factors.

9. Can a person buy 2 term insurance?

Yes, you can buy two or more term insurance plans based on your coverage needs. However, when buying multiple plans, it is recommended to inform the insurance company of your existing plans.

10. What is 5-year term insurance?

A term plan having a coverage tenure of 5 years is called a 5-year term insurance plan.

11. What is the 3-year rule of term insurance?

The 3-year rule states that the insurer has 3 years for calling a policy in question on the ground of misrepresentation or suppression of facts, from the date of issuance of Policy or date of commencement of risk or date of revival of policy or date of rider of the policy, whichever is later. Once this period of 3 years is over, the insurer cannot call the policy in question. 2 .

12. At what age term insurance is best?

Buying a term insurance plan from a younger age is recommended so that you can enjoy coverage earlier. Moreover, buying young allows you to enjoy lower premiums on the policy.

13. How long should I pay term insurance?

The premium payment term should depend on your affordability. Term plans might offer regular, limited and single premium payment terms. Assess your finances and choose a term that aligns with your budget.

14. What is the waiting period in term insurance?

There is no waiting period for natural death or accidental death under term insurance, except for death by suicide. For death by suicide, there is a waiting period of 1 year from policy commencement.3

Life Insurance Guide

Videos

Articles

Calculators

Podcasts

Death benefit is the amount that the life insurance company provides to the beneficiary in case of unforeseen demise of the life assured during the policy tenure

Cracking the Code: Understanding Annualized Premium in Insurance

A type of life insurance policy that covers two lives under a single plan, typically taken by spouses.

Understanding #lifeinsurance terms may be challenging. As part of Bajaj Allianz Life’s #LifeInsuranceMadeEasy series we are simplifying industry terminology

Watch this video from the #LifeInsuranceMadeEasy series, a customer education initiative by Bajaj Allianz Life to know how Autopay simplifies the premium

#Lifeinsurance terms got you mixed-up? As part of #LifeInsuranceMadeEasy series, Bajaj Allianz Life’s is helping to simplify industry terminologies

One of the most effective methods of providing for your family in your absence is term insurance. .....

Many people may opt for a term insurance policy to secure their family’s financial future in their absence. The financial support received from a term insurance...

Ask this question, and the primary reason that would come to mind would be comprehensive coverage. Term plans cover death of the life insured during the....

Even at the best of times, life can be unpredictable and emergencies can strike without a moment’s notice. Therefore, in order to never find yourself in.....

With the Underinsurance Calculator, check if your Life Cover is atleast 10x of your Annual Income.

Answer a few easy questions to calculate your Fixed Deposit Returns.

Calculate your NPS returns effortlessly with our simple to use NPS Calculator.

Plan your investments effortlessly and achieve your financial goals with our easy-to-use SIP Calculator.

Answer a few simple questions to know how prepared you are for your retirement.

Answer a few simple questions to know the corpus required to fulfil your Life Goal.

A simple to use and comprehensive tool to plan for your child's education.

An easy to use Term Insurance calculator to determine the right life cover amount as per your needs.

Use this calculator to know how savings from regular expenses can help you achieve your Life Goals.

Get to know your Financial Fitness Score by answering few simple questions.

Use our immunity calculator to find out your immunity score in just a few clicks!

Know the amount to invest today to have the corpus to accomplish your Life Goals tomorrow.

Get an estimate of how much your investment will grow over a period of time.

Know your income tax based on the taxable income and explore Life Insurance plans to save more tax.

A simple to use calculator that helps you plan for fulfilling your Child's Life Goals.

Calculate the amount you need to invest today to accomplish your retirement life goals.

Answer a few simple questions to know estimated corpus you will have to fulfil your Life Goals.

Body Mass Index (BMI) is a measure to understand whether your body weight is healthy as per your height.

ft. Mr. Sameer Joshi, Chief Agency Officer, discussing how to manage finances for financial freedom.

Mr. Sampath Reddy, Chief Investment Officer, shares his views on the Union Budget 2023.

Mr. Dheeraj Sehgal, CDO – IB & Mr. Jatin Popat, WillJini discuss Will Writing & Succession Planning.

ft. Mr. Ajay Rajvanshi, Sr. EVP, as he shares his views on building wealth with SISO.

Mr. Rajesh Krishnan, COO, discusses immense investment potential of India for NRIs.

% Above illustration is for Bajaj Allianz Life eTouch- A Non-Linked, Non-Participating, Individual Life Insurance Term Plan (UIN:116N172V04) considering Male aged 24 years | Non-Smoker | Policy Term(PT)– 30 years | Premium Payment Term (PPT)– 30 years | Sum Assured opted is Rs.1,00,00,000 | Online Channel | Standard Life | 1st Year Premium is Rs. 6,348. 2nd Year onwards premium Rs. 6,780. Total Premium Paid is Rs. 2,02,968 | Medical Rates | Monthly Premium Payment Mode | Death benefit opted is lumpsum payout and monthly instalments (Lumpsum Payout Percentage: 45, Income Payout Percentage:55) | Premium shown above is inclusive of Online Discount only and exclusive of Goods & Service Tax/ any other applicable tax levied, subject to changes in tax laws, and any extra premium and is for illustrative purpose only.

*Above illustration is for Bajaj Allianz Life eTouch- A Non-Linked, Non-Participating, Individual Life Insurance Term Plan (UIN:116N172V04) considering Male aged 40 years | Non-Smoker | Policy Term(PT)– 30 years | Premium Payment Term (PPT)– 30 years | Sum Assured opted is Rs.1,00,00,000 | Online Channel | Standard Life | 1st Year Premium is Rs. 21,120. 2nd Year onwards premium Rs. 20,110. Total Premium Paid is Rs. 6,32,256 | Medical Rates | Monthly Premium Payment Mode | Death benefit opted is lumpsum payout and monthly instalments (Lumpsum Payout Percentage: 45, Income Payout Percentage:55) | Premium shown above is inclusive of Online Discount only and exclusive of Goods & Service Tax/ any other applicable tax levied, subject to changes in tax laws, and any extra premium and is for illustrative purpose only.

@Individual Death Claim Settlement Ratio for FY 2024-2025

$96.70% of non-investigative individual claims approved in one working day for FY 2023-24. 1 day is counted from date of intimation of claim before 3 PM on a working day (excluding Non-NAV days for ULIP) at Bajaj Allianz Life offices

**Solvency ratio 359% as at 31 March 2025 against IRDAI mandated 150%

# Survey conducted by Brand Equity – Nielsen in March 2020

&For details refer to press release published by CARE

BJAZ-WP-ECNF-08927/24

-Calculator.svg)